Capital Market Trends: What Investors Need to Know in 2024

Table of Contents

- jaro education

- 22, May 2024

- 10:38 am

When it comes to the global economy, the capital market has a prominent role to play. This market serves as a podium for various governments and organizations to raise funds for different purposes. Investors should know about capital market trends because staying informed about the trends in the capital market can help them make informed investment decisions. Understanding capital market trends allows investors to identify potential opportunities for growth and profitability. By monitoring trends such as stock price movements, interest rates, economic indicators, and industry performance, investors can adjust their investment strategies to capitalize on emerging opportunities or mitigate risks.

This blog will highlight the capital market trends in 2024. But before getting deeper into the trends, let’s understand what the capital market is and what its types and functions of the capital market.

What is a Capital Market?

A capital market is a financial market where one can trade long-term financial instruments such as stocks, bonds, and other securities. It is a platform that brings together suppliers of capital, such as banks and investors, with entities that need capital for long-term investment, such as businesses, governments, and individuals. Capital markets facilitate the buying and selling of financial instruments, enabling businesses to raise long-term funds for fixed capital requirements and investors to invest in securities for their future. They are crucial for economic growth and wealth creation, as they provide a reliable source of funding for businesses and investment opportunities for individuals.

Capital markets cover various platforms, online and offline, where different financial assets are traded. These include stocks, bonds, and currencies. Most trading occurs in major financial centers like New York, London, Hong Kong, and Singapore.

*sketchbubble

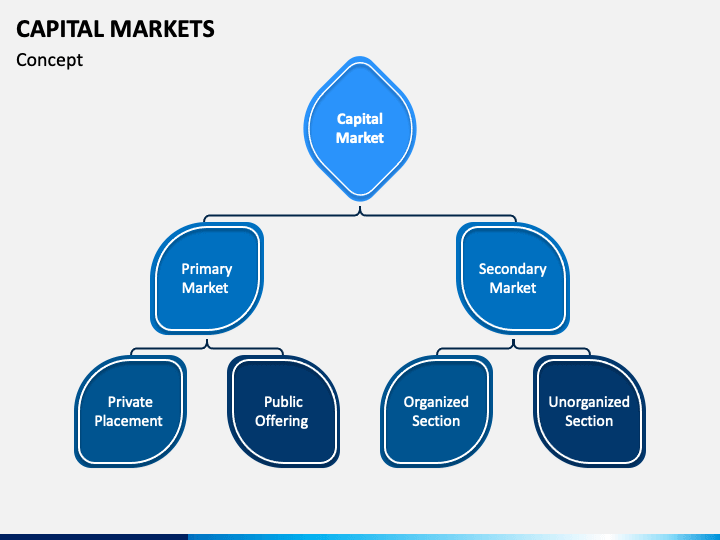

What are the Types of Capital Markets?

Two types of capital markets primarily exist, which are discussed below.

Primary Market

In the primary capital market, a company sells new stocks or bonds to the public, like in an initial public offering (IPO). This market, also called the new issues market, allows investors to buy securities directly from the company. To make this happen, the company works with an underwriting firm to assess its offering and create a detailed prospectus describing the securities being issued.

Strict regulations govern all offerings in the primary market. Companies are required to submit filings to regulatory bodies like the Securities and Exchange Commission (SEC) and other relevant securities agencies. They must await approval of these filings before proceeding with their public debut.

Securities in the primary market are often inaccessible to small investors as companies and their investment bankers prioritize rapid distribution of all available securities to fulfill volume demands. Their marketing focus leans towards attracting large investors capable of making significant purchases. These promotional activities often involve roadshows or presentations, during which investment bankers and company executives engage with potential investors to underscore the value of the securities on offer.

Secondary Market

Within the secondary market, previously issued securities are exchanged among investors on platforms regulated by entities like the SEC (Security and Exchange Commission). Unlike the primary market, issuing companies do not play a role in secondary market transactions. Nasdaq and the New York Stock Exchange are examples of secondary marketplaces.

Within the secondary market, there are two primary categories: auction markets and dealer markets. Auction markets employ an open outcry system, where buyers and sellers gather in a single location to openly declare the prices at which they wish to buy or sell securities. On the other hand, dealer markets facilitate trading through electronic networks, with many small investors preferring this method.

Structure of the Indian Capital Market

The Indian capital market is a crucial component of the country’s financial system, serving as a vital link between savers and investment opportunities. It is structured into two main categories: the primary market and the secondary market.

The primary market is where new securities are issued for the first time, facilitating the transfer of newly issued shares from companies to investors. This market is primarily composed of financial institutions, banks, high-net-worth individuals (HNIs), and other similar entities.

The secondary market, on the other hand, is where the trading of securities actually takes place. This market is often referred to as the stock market, and it is where existing investors sell their securities to new investors. The main participants in this market are stock exchanges like the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE).

In addition to stocks, the Indian capital market also deals with other financial instruments such as bonds, derivatives, and cash. Bonds are double the size of equity markets, followed by equity, which is double the value of derivatives.

*elearnmarkets

Functions of Capital Market

The capital market has multi-faceted functions, which will be discussed in the following points.

Formation of Capital

Capital markets serve as crucial channels for facilitating the flow of capital, allowing companies and entities to raise funds for diverse objectives. Utilizing avenues such as initial public offerings (IPOs) and bond issuances, organizations acquire essential capital to support growth, finance research and development endeavors, and pursue strategic initiatives.

Connects Investors and Borrowers

Capital markets play a fundamental role as intermediaries, bridging the gap between entities seeking funds (borrowers) and those seeking investment opportunities (investors). Borrowers, which can include companies and governments, raise capital by issuing securities, while investors allocate their funds to these securities, establishing a mutually beneficial relationship.

Reduce Transaction Time and Cost

Efficiency is a hallmark of capital markets, achieved through the mitigation of transaction costs and the swift execution of securities transactions. Electronic trading platforms and refined procedures play key roles in driving down costs and accelerating transaction times, delivering tangible benefits to investors and issuers.

Enhances Investment Opportunities

Capital markets present a wide array of investment options for both individual and institutional investors. Whether opting for stocks, bonds, or alternative financial instruments, investors can customize their portfolios to match their investment goals, time frame, and risk tolerance.

Capital Liquidity

Liquidity is essential for capital markets. It keeps them running smoothly by enabling constant trading so investors can easily buy or sell securities. This smooth conversion of investments into cash boosts market efficiency and inspires confidence in participants. With liquidity, capital markets become lively places where investors can react quickly to market changes, take advantage of opportunities, and handle risks well.

Capital Market Trends to Know About in 2024

Capital market trends keep on changing; let’s check what trends are set to prevail in 2024.

Amplified Digitization in the Captial Market

The capital market is experiencing a significant transformation driven by technological advancements. The rise of digitization has introduced a new era characterized by the increasing online trading platforms, the integration of algorithmic trading systems, and the utilization of artificial intelligence (AI) in investment strategies.

Online trading platforms have democratized access to the capital market, empowering investors of all sizes to participate in trading activities from the convenience of their devices. Meanwhile, algorithmic trading has revolutionized trading practices by executing high-speed transactions based on pre-defined parameters, enhancing market liquidity and efficiency.

Increased Alternative Investment Options

Investors are no longer limited to traditional asset classes like stocks and bonds. The rise of alternative investments such as private equity, venture capital, real estate, and cryptocurrencies has reshaped the investment landscape. These alternative avenues offer investors opportunities for diversification beyond traditional markets and the potential for higher returns. However, it’s important to note that alternative investments also carry heightened levels of risk, requiring investors to assess and manage their investment strategies carefully.

Volatility Due to Global Events

Global events, like geopolitical tensions, economic downturns, and pandemics, may significantly impact capital markets by introducing volatility and uncertainty. Investors need to adapt their strategies accordingly to navigate through these challenging times. Being prepared to adjust investments and portfolios in response to changing market conditions becomes crucial in managing risks and seeking opportunities amidst the fluctuating landscape shaped by such events.

Surge in ESG Investments

In recent years, Environmental, Social, and Governance (ESG) factors have attracted many investors. Investors are showing a growing interest in sustainability and ethical considerations when it comes to making investment choices. This shift in mindset has sparked the proliferation of ESG-focused funds, which specifically target companies that adhere to environmental, social, and governance (ESG) principles. Additionally, there’s been a notable trend towards the incorporation of ESG metrics into investment strategies across various sectors. This reflects a broader recognition among investors of the importance of aligning financial goals with ethical and sustainable practices in the pursuit of long-term value creation.

Introduction of Emerging Markets as a Result of Globalization

Globalization refers to the increasing integration of economies around the world, particularly through the movement of goods, finance, and people. This process has significantly impacted emerging market economies (EMEs), which possess some of the qualities of developed countries and are transitioning from a low-income, often pre-industrial economy towards a modern, industrial economy with a higher standard of living. Globalization has opened up opportunities for investors to tap into these emerging markets, which present attractive investment prospects due to their robust economic growth.

However, investing in EMEs requires careful analysis of political, financial, and regulatory factors. This is because EMEs can be more volatile and subject to greater risks, such as political instability, lower liquidity, currency fluctuations, and investment volatility.

Changes in Regulations

Capital markets operate within a constantly evolving regulatory environment, where changes in regulations have profound effects on market dynamics and investment strategies. For instance, regulatory shifts can affect compliance requirements, trading practices, and investor protections. Investors must remain vigilant and informed about these regulatory developments to make well-informed decisions and adapt their strategies accordingly. Staying abreast of regulatory changes in 2024 will ensure effective navigation in the market, mitigate risks and capitalize on emerging opportunities while complying with legal standards.

Final Thoughts

As we move through 2024, investors need to stay informed about the changing capital market trends. Understanding the rise of sustainable investing and technological advancements is crucial. Diversification, monitoring regulations, and recognizing liquidity’s importance are also key. By staying vigilant and adaptable, investors can seize opportunities and manage risks effectively in the ever-evolving world of capital markets.

As capital market trends keep evolving with time, you need to have a grasp of it to understand the minute details. If you want to learn more about capital markets and related topics, the Online Master of Commerce course by Chandigarh University can help. This 24-month course can have a transformational effect on your career for its unique offerings. By participating in this course, you get access to the best academicians and industry experts. This universally accepted online degree course is considered equal to CU’s offline degree programs. With built-in internships and job opportunities, you can even get an early bird discount of 25%. So, wait no more; accelerate your academic journey now!