Top 15 Primary Goals of Financial Management in 2024

Table of Contents

- jaro education

- 29, May 2024

- 4:30 pm

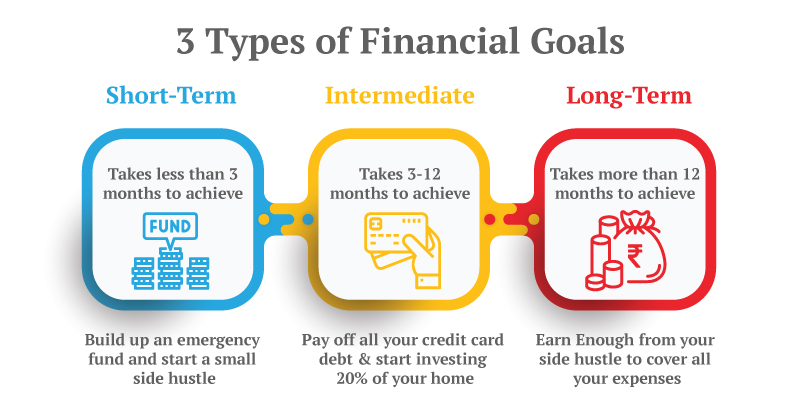

The goals of Financial Management should be predefined for effectively managing corporate and personal finances. But what is the primary goal of financial management? To avoid situations like your business going bankrupt or facing major losses, you must know the goals and objectives of financial management. To reach certain goals, one must know how to plan, arrange, and regulate financial resources. Although, based on an organization’s size, industry, and goals, the aims of financial management may vary.

In this blog, we will discuss what financial management is and explain the goals of financial management.

What is Financial Management?

The art of planning, organizing, directing and controlling your financial resources to achieve your desired goals is called financial management. The purpose of financial management is to mainly concentrate on oversight over revenues and expenditures, managing risk and capital.

15 Major Goals of Financial Management

The goals of financial management depend on efficient and effective management of financial resources. Some of the main goals are described below.

*canarahsbclife.com

1. Profit maximization

Profit maximization is the primary objective of financial management. This means a company should make decisions that increase its earnings per share (EPS) and overall profitability. Let’s shed some light on profit maximization.

A company’s success evaluation is done through profitability, as it indicates the capability to make money. Although there are various views on short-run gains vs. long-run growth, pre-tax profits vs. net income, and earnings per share, they all lead to one thing: maximizing revenue. However, this understanding should also take into account the time value of money and recognize that investment decisions can affect future incomes. Such an examination considers gross margin or net revenue alone and how these numbers can be grown over time through strategic asset purchases and business developments. In the end, a firm’s profit-making capacity does not just benefit itself; it ensures equitable distribution of capital, labor, and infrastructure resources, thus contributing to social and economic welfare.

2. Wealth Maximization

When it comes to the goals of financial management, one must concentrate on the maximization of wealth. The strategy of maximizing wealth in finance management targets enhancing a company’s worth by elevating the share value owned by shareholders. In doing so, the management team must always strive to achieve the highest returns on invested capital while considering risk level. The reason why wealth maximization outweighs profit maximization is that it takes into account a wider scope because this more modern approach considers a rupee today worth more than tomorrow.

3. Accurate Estimation of Financial Requirements

Another purpose of financial management is to ensure that a business has enough money to begin and operate smoothly and knows its financial needs. This involves finding out what other people in the same line of business are doing to anticipate their initial sales, making sure that all funds available, such as loans and retained earnings, have been put into consideration while preparing budgets, which should be strictly followed when calculating production costs in terms of labor used together with materials required plus overhead incurred; also they need to include some alternative plans in case things do not go according to plan due unexpected expenses arising from market changes among others.

4. Appropriate Mobilization

Appropriate mobilization is one of the primary objectives of financial management. It is essential for businesses’ prosperity now and also in the future. It refers to the way cash should be used at different stages of a business cycle; this may involve resource allocation within departments (mobilization), maintaining liquidity necessary for meeting current obligations or capturing opportunities as they arise, setting realistic targets against which performance can be measured over time(financial control)and drawing lessons from past overspending mistakes with a view improving on future budgets. In simple words, good financial management means spending wisely toward short-term and long-term goals.

5. Maintenance of Liquidity

To explain the goals of financial management, one needs to understand the importance of liquidity maintenance. In financial management, liquidity maintenance means managing a company’s cash and financial resources to have enough liquidity to meet its financial obligations as and when they become due. It involves methods and actions directed toward enhancing, optimizing and preserving the liquidity position of an entity.

For complex organizations with international operations to effectively manage risk, liquidity management should prioritize clear visibility into the cash flow through centralized systems; this is equally important for them as it helps identify and mitigate situations where the company lacks enough money. Such practices also improve financial performance by enabling businesses to save towards payments, shun debt or asset fire sales, and establish a strong financial base.

6. Resource Allocation Efficiency

One of the goals of financial management is how to use resources, specifically financial resources effectively to the areas that generate considerable revenues. Through strategic functions alone can financial management guarantee the well-being of an organization; fund distribution assigns resources on the value and future potentiality, among others.

Financial planning comes up with roadmaps with goals accompanied by strategies supported by specific funds for their accomplishment. At the same time, financial control ensures spending optimization and risk management, as well as being proactive in identifying any threat that may face finance. Finally, informed investment decisions only happen after evaluating possible returns against the risks involved; thus, such activities must work hand in glove so that firms can make good choices about what will enable them to achieve success over a long duration.

7. Accelerated Productivity

Money management aims to increase company swiftness by shortening operations, reducing costs and streamlining resource utilization. This means that one should measure efficiency using indicators like ROI (return on investment), gross margin as well as OER (operating expense ratio).

Enhanced business efficiency involves maximizing time, effort and resources; minimizing costs while maximizing returns on invested capital. This particular purpose of financial management is achieved through managing financial resources to achieve corporate objectives.

8. Settling Financial Obligations with Lenders

Financial management enables firms to meet their obligations to creditors in the form of loan repayment and honoring contractual agreements. It involves budgeting for funds distribution, keeping investor relations alive, and implementing successful management ideas like strict borrowing terms, conservative regulations and risk assessment, among others, to ensure financial stability together with profitability for a company.

9. Capital Cost Reduction

Another purpose of financial management is to minimize a company’s capital cost through inexpensive financing choices, optimal capital structures and debt management. The rate of return needed for a business’s value creation is called the cost of capital. Since it maximizes market value and minimizes capital costs simultaneously, the best mix between equity financing and borrowed funds is represented by what is referred to as optimum capital structure. Long-term strategies are made possible when we plan well financially as this prepares us with investment decisions while also giving information on funding requirements, profitability levels, and liquidity positions, among other things, such as cash flow projections, which help in determining how long a given business could survive without making any sales.

10. Reducing Operational Risk

Financial management incorporates risk management strategies to mitigate operational risks and protect investments. That includes diversification of investments, hedging against losses, controlling cash flows, managing debts, and preparing contingency plans.

The above methods explain the goals of financial management of a business and investors to spread their eggs across different baskets, thereby minimizing potential losses while maximizing returns on investments with minimal exposure to loss.

11. Equilibrium Construction

According to financial management, equilibrium construction is achieved by managing debt and equity, ensuring liquidity, and optimizing capital structure to meet organizational objectives.

One of the goals of financial management is to find the right capital structure, which leads to minimum weighted average cost of capital (WACC) and maximum enterprise value. In this regard, it should be noted that firms with stable cash flows may carry more debts, while those with uneven cash flows will have fewer debts but higher equities.

12. Imagination of Financial Scenarios

Financial scenarios are created by the primary objective of financial management to analyse economic situations and make informed decisions. Through scenario analysis, managers can project future happenings and profitability. Scenario analysis has four main components: planning, budgeting, forecasting, and risk management. Furthermore, financial performance evaluates a company’s ability to utilize assets for income generation. At the same time, risk management involves strategies to reduce risks, such as portfolio diversification and asset allocation, including position sizing, which is essential when dealing with large investments for individuals and organizations alike.

13. Determine Your Prosperity

Monetary management consists of establishing monetary measures and performance markers for gauging the success and profitability of an enterprise. Such indicators, including sales growth, earnings per share, customer loyalty or product quality, are important in establishing whether a company is financially stable. Knowledge about these signs and continuous monitoring helps organizations find areas where they need to improve; it enables them to make informed decisions based on data that will lead to the purpose of financial management, which is their growth and prosperity.

14. Optimisation of marketing activities

Financial management optimizes marketing efforts through resource allocation, ROI assessment and alignment of tactics with financial objectives. Businesses should set goals and KPIs and regularly evaluate and analyze their undertakings. Successful marketing strategies create a strong market presence and engage with target customers while maximizing coverage. When financial goals are aligned with marketing analytics, ROI will be enhanced.

15. Business Survival

A business cannot survive without sound financial management practices because it is through planning, controlling the decision-making process, and analysis that a strategy can be formulated to achieve sustainable growth for any organization. Strategic plans must have measurements embedded into them together with financial targets so that revenue may be generated while ensuring a reasonable return on investment (ROI). Good plans provide clear direction by explaining policies.

Takeaway

To explain the goals of financial management, all we can say is that businesses can enhance their financial efficiency, raise profits, and secure their future through the use of financial management. These tactics must be tailored to suit every company’s different needs and objectives. Besides, reviewing and modifying financial plans regularly for long-term success is necessary.