Perfect Competition: Examples and How It Works

Table of Contents

- jaro education

- 22, July 2024

- 12:00 pm

Perfect competition in economics is a theoretical market structure that serves as a benchmark for understanding how supply and demand influence prices and behavior in a market economy. While it rarely occurs in perfectly competitive markets, it provides valuable insights into ideal market conditions.

*eCampusOntario

Rightly said, in a perfect competition market, numerous buyers and sellers interact, and prices accurately reflect the balance of supply and demand. Companies in this model earn just enough profit to remain operational without excess. New companies would swiftly enter the market if they were to generate surplus profits, driving profits back to equilibrium levels.

What is Perfect Competition in Economics?

According to economic theory, this is a type of market where many small firms are competing with each other so that no firm can change the market price. Market structures of this type are considered perfectly competitive structures since they assume that the only participants in the market act as price takers.

The two concepts of perfect competition and monopoly are further differentiated from oligopoly, in which only a few large firms have left their marks in the market. A good will be homogeneous in that market with free entry and exit. The entry of all firms into perfection will only optimize them in competition, thus improving consumer prices and welfare maximization.

Features of Perfect Competition

To fully grasp the concept of perfect competition, we must examine its defining features. Economists studying macroeconomics and microeconomics use these ideal characteristics as reference points to analyze real-world perfect competition market operations:

*EDUCBA

| Feature | Description | Example |

|---|---|---|

| Homogeneous Products | All firms produce identical products with consistent quality, creating a commodity market. | Wheat from different farms is virtually indistinguishable; buyers do not differentiate between sellers based on product quality. |

| Price Takers | Firms have no control over pricing; they must accept the market price, which is determined by supply and demand. | Currency traders must accept the current market rate in the foreign exchange market. |

| Limited Profitability | Short-term profits may occur, but long-run equilibrium ensures no firm makes an economic profit due to market entry by new producers. | Farmers who increase yields initially earn more, but as others adopt similar methods, prices drop, and profits normalise. |

| Free Entry and Exit | No barriers exist for firms to enter or exit the market; new firms can start competing without significant costs, and existing firms can leave easily. | Freelancers can enter the market by offering services online and exit without financial repercussions. |

| Rational Buyers | Buyers make informed, rational decisions to maximise their economic utility, with perfect information about products and prices. | Investors in an ideal stock market have complete information about companies and make rational decisions based on that knowledge. |

| Mobile Resources | Labour and capital can move freely to where they are needed without associated costs, enabling resource reallocation. | Workers can switch between jobs or industries seamlessly without retraining costs or geographical constraints. |

| Minimal Regulation | There are no external regulations affecting production, sales, or use of goods, as there are no negative externalities or third-party impacts. | In a perfectly competitive apple market, there would be no need for government regulation on pesticide use, labour practices, or pricing controls. |

These characteristics create an ideal framework for understanding market dynamics, though it’s important to note that such perfect conditions rarely, if ever, exist in real-world perfect competition markets. Nonetheless, this model provides valuable insights for economic analysis and policy-making.

Examples of Perfect Competition

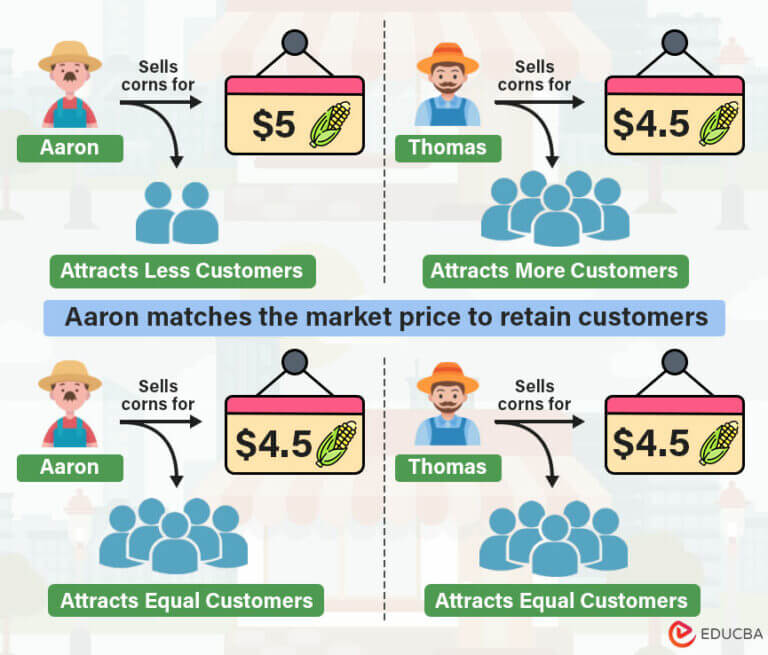

While perfect competition is largely theoretical, some perfect competition markets exhibit characteristics that come close to this ideal model. Let’s explore some perfect competition examples that demonstrate aspects of perfect competition in economics:

*Ingenious-e-Brain

| Market | Description | Example |

|---|---|---|

| Crop Farming | Agricultural products like vegetables and grains are often interchangeable, with minimal differentiation between producers. | Different farms produce similar wheat or vegetables; if one stops, it doesn't significantly affect market prices. |

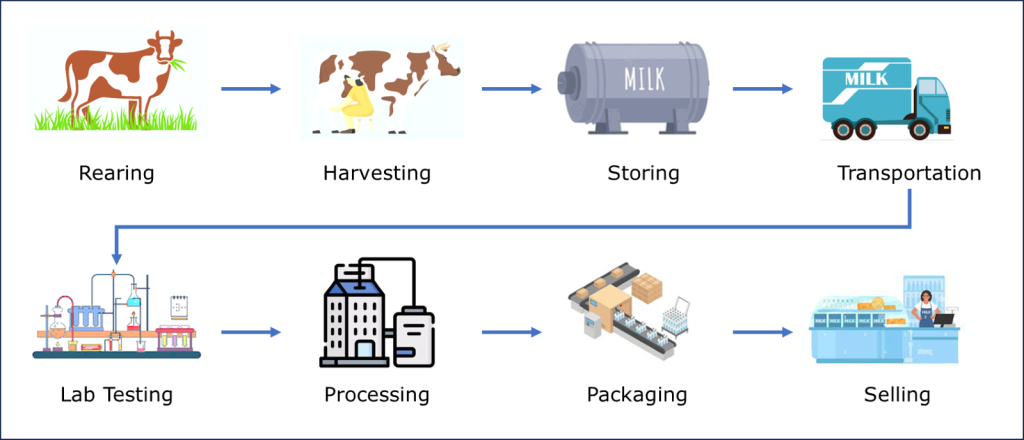

| Dairy Industry | Milk sourced from various dairies remains essentially the same, with closely aligned retail prices, and consumers don’t notice differences. | Supermarkets can easily switch dairy suppliers without impacting the consumer experience. |

| Supermarket Sector | Competing supermarkets often stock identical products with similar wholesale and retail prices, including generic ‘house brands’. | House brands are often cheaper versions of big-name products, supplied by the same manufacturers but differently packaged. |

| Bakery Market | Basic bread loaves across different bakeries are nearly identical in recipe, packaging, and pricing, making the brand name the only difference. | Consumers can buy basic bread from various shops and receive an almost identical product. |

| Technology Sector | Open-source software, cloud computing, and low hardware costs make launching tech companies affordable, showcasing some traits of perfect competition. | Online companies can start with minimal investment, thanks to reduced costs in software and hardware. |

These examples highlight markets that, while not perfectly competitive, exhibit some of the key characteristics of the theoretical model.

Advantages of Perfect Competition

Perfect competition offers several theoretical benefits to market participants and the economy as a whole:

- Consumer-Centric Approach: Perfect competition markets prioritize consumer interests. Buyers have readily available substitutes for both products and sellers, allowing them to easily switch if necessary.

- Fair Pricing: Unlike monopoly markets, sellers in perfect competition lack pricing power. The demand and supply chain maintains absolute control over pricing, minimizing the potential for consumer exploitation.

- Standardized Quality: In perfectly competitive markets, product features, quality, and prices remain consistent across different locations. For instance, toothpaste quality and prices in London or Manchester would be nearly identical, ensuring consumers receive standardized products everywhere.

- Low Entry Barriers: Perfect competition features low start-up, production, advertising, and marketing costs. This makes it easier for new sellers to enter the perfect competition market and begin production and sales.

Disadvantages of Perfect Competition

Despite its theoretical benefits, perfect competition also has some drawbacks:

- Theoretical Nature: The primary disadvantage of perfect competition is its status as an ideal perfect competition market structure. It remains largely a hypothetical concept in economics, with minimal real-world existence.

- Limited Product Differentiation: Sellers in perfectly competitive markets struggle to add value to their products. Introducing new features or improvements doesn’t necessarily translate to higher prices, as these are controlled by supply and demand. This can lead to decreased profit margins for sellers attempting to innovate.

- Intense Competition: The low barriers to entry and exit in perfect competition result in heavy competition for sellers. New players can enter the perfect competition market at any time, offering similar products or services at comparable rates.

Perfect Competition vs Monopoly

To better understand perfect competition, it’s helpful to compare it with its theoretical opposite: monopoly. A monopoly is characterized by a single product seller with no close substitutes. Let’s examine the key differences:

*EDUCBA

| Basis | Perfect Competition | Monopoly |

|---|---|---|

| Number of Sellers | firms | Single firm |

| Barriers to Entry | Very low | Very high |

| Substitute Products | Good substitutes are readily available | No good substitutes are available |

| Competitive Strategy | Firms compete through prices only | Companies compete through product features, quality, advertising, and marketing |

| Pricing Power | Negligible, dependent on supply and demand | Significant, companies can manipulate prices as desired |

Industries Incompatible with Perfect Competition

In theory, perfect competition in economics is an ideal market efficiency model. However, several industries cannot operate within a perfectly competitive market due to various constraints. Let’s explore some sectors that lack the essential features of perfect competition:

| Industry | Description | Reason for Deviation from Perfect Competition |

|---|---|---|

| Oil and Gas Industry | Requires substantial investments in exploration, drilling, and infrastructure, creating high entry costs. | High Entry Barriers: Massive initial investment contradicts the free-entry principle of perfect competition. |

| Vehicle Manufacturing | Demands significant capital for production, making it hard for new companies to enter the market. | High Capital Requirement: Substantial upfront costs prevent free market entry, violating a key feature of perfect competition. |

| Pharmaceutical Industry | Operates under strict regulations for development, testing, and production, with high R&D costs creating major entry barriers. | Regulatory and Financial Barriers: High R&D expenses and stringent regulations limit new firms from entering freely. |

| Utility Sector | Subject to government regulations on capacity, power agreements, and contingency plans, limiting market mobility. | Restricted Entry and Exit: Strict government controls hinder the free movement of firms, conflicting with perfect competition. |

These industries demonstrate significant deviations from the ideal model due to factors like high entry costs, regulatory constraints, and substantial capital requirements.

Final Thoughts

Perfect competition in economics serves as a valuable theoretical model for understanding perfect competition market dynamics. While rarely found in its pure form in the real world, many markets exhibit some characteristics of perfect competition. By studying this concept, economists and business leaders gain insights into pricing strategies, perfect competition market entry decisions, and consumer behavior. In a perfectly competitive market, firms produce homogeneous products, act as price takers, and operate in an environment with free entry and exit.

Elevate your career with Manipal University’s online MBA program. Enjoy 1,000+ hours of cutting-edge tutorials through live and recorded lectures. Gain a broader worldview with top-tier faculty and real-world mentors. Collaborate with peers and tackle real-world case studies in a rigorous learning environment. Benefit from career counseling and career assistance by Jaro Education. Choose Manipal for a transformative educational experience that prepares you for leadership in today’s competitive business landscape.

Frequently Asked Questions

Perfect competition is a theoretical market structure in which numerous small firms sell identical products, and no single firm can influence the market price. In a perfect competition market, the forces of supply and demand drive the price, and all participants (both consumers and producers) are considered price takers. This means that firms must accept the market price as given and cannot set their prices.

There are several key characteristics of perfect competition:

-

- Large Number of Sellers and Buyers: There are many firms in the market, each producing a small fraction of the total output.

- Homogeneous Products: All firms sell identical or standardized products with no differentiation between them.

- Free Entry and Exit: Firms can enter or exit the market with no barriers or restrictions.

- Perfect Knowledge: Both buyers and sellers have complete information about prices, quality, and other factors influencing the market.

- Price Takers: Firms are price takers, meaning they cannot influence the price and must accept the prevailing market price.

Perfect competition is often considered the most efficient market structure because it leads to the lowest possible prices for consumers while ensuring that resources are allocated efficiently. In this market, firms produce at the lowest possible cost, leading to productive and allocative efficiency. Consumers benefit from lower prices and a high level of consumer surplus.