Forensic Accounting Simplified: The Fearless Investigation of Financial Crimes

Table of Contents

- jaro education

- 4, November 2024

- 10:00 am

In today’s increasingly complex financial environment, forensic accounting has become a vital field in India, where economic growth and globalization have made companies more susceptible to financial fraud and corporate misconduct. As one of the fastest-growing branches of accounting, it combines investigative prowess with in-depth financial expertise, creating a unique role that protects businesses and upholds financial integrity. Tasked with the responsibility of detecting and preventing financial irregularities, forensic accountants are like detectives, meticulously analyzing financial data to uncover fraud, embezzlement, and other forms of misconduct.

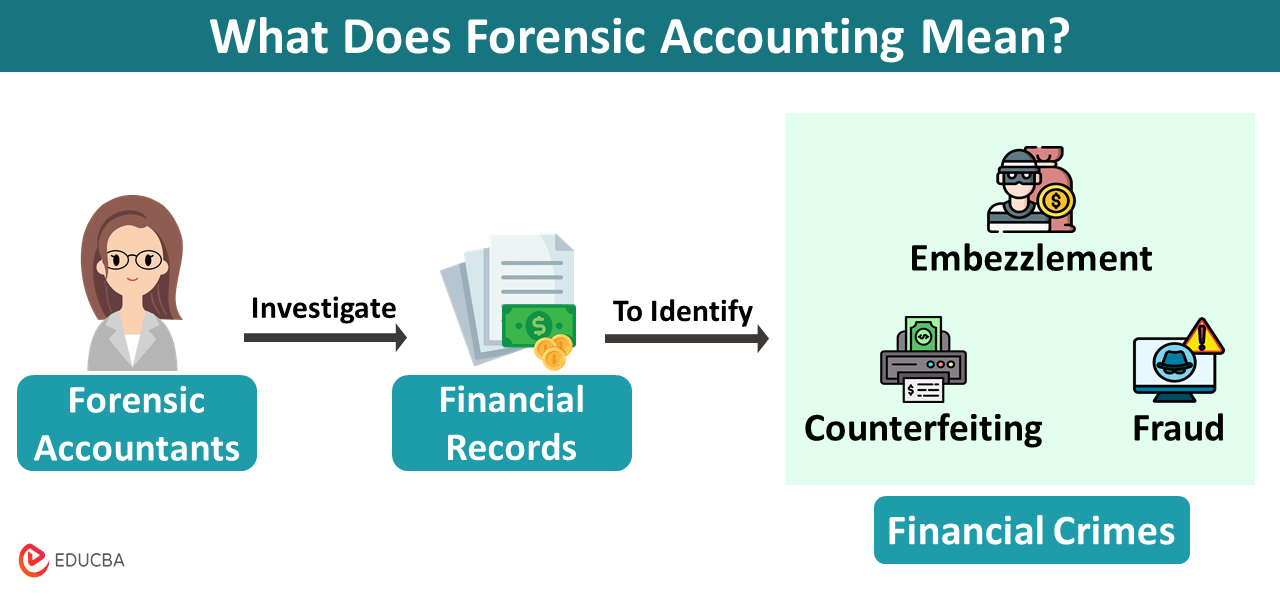

What is Forensic Accounting?

Forensic accounting is a specialized branch of accounting focused on investigating financial discrepancies, fraud, and misconduct. Forensic accountants analyze complex financial transactions and provide expert testimony in court cases, acting as financial detectives. In India, forensic accountants are increasingly employed by government agencies, corporate entities, and consulting firms, where they uncover and prevent financial malfeasance, contributing to transparency and accountability.

*EDUCBA

Key Roles of Forensic Accountants in India:

| Role | Description |

|---|---|

| Fraud Detection and Prevention | Analyzing financial records to identify fraud or suspicious transactions. |

| Litigation Support | Providing expert testimony and financial analysis in legal proceedings. |

| Financial Crime Investigation | Investigating cases of embezzlement, bribery, and corruption. |

| Internal Audits and Risk Management | Evaluating a company’s internal controls to mitigate risk. |

Importance of Forensic Accounting in India

In India, the importance of forensic accounting is on the rise, driven by high-profile cases of financial fraud and regulatory developments aimed at enforcing accountability. With regulations like the Prevention of Money Laundering Act (PMLA) and the Goods and Services Tax (GST) transforming India’s compliance landscape, the profession has become indispensable for organizations striving to meet these new standards. Forensic accountants are not only key players in detecting fraud but also support litigation by providing expert testimony and comprehensive investigative reports that can be used as evidence in court.

Moreover, as India moves further into the digital age, forensic accountants are increasingly applying digital forensics and data analytics to stay ahead of sophisticated cybercrimes and online fraud. Their work spans across diverse industries—from banking and insurance to technology and manufacturing—helping businesses mitigate financial risk and instill confidence among investors and stakeholders. This unique combination of financial knowledge, investigative skill, and technological adaptability makes forensic accounting an exciting and impactful career path in India’s rapidly evolving financial sector.

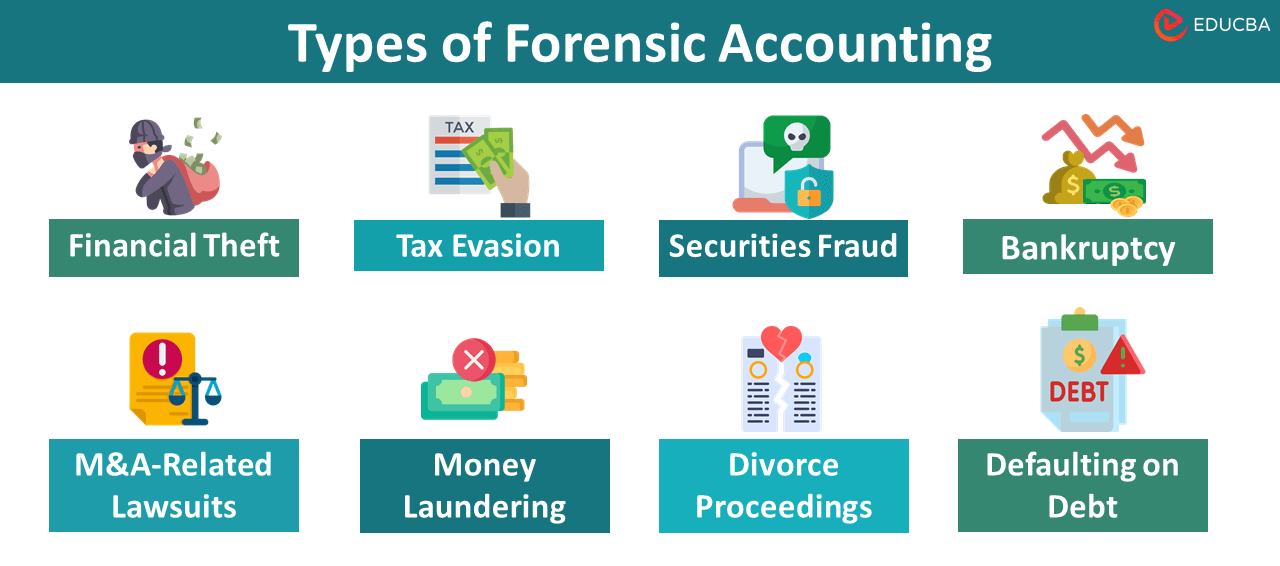

Types of Forensic Accounting in India

Forensic accounting encompasses a wide range of practices, each focused on a unique aspect of financial investigation. Here are some common types of forensic accounting that professionals in India may encounter:

- Fraud Detection and Investigation: Forensic accountants often work with companies to detect fraudulent activity, from financial statement fraud to employee embezzlement.

- Compliance Auditing: Many forensic accountants work with regulatory bodies like the RBI and SEBI to ensure companies are following financial regulations.

- Litigation Support: Forensic accountants provide detailed financial analysis that supports legal proceedings, including civil and criminal cases.

- Insurance Claims Investigations: In cases of high-value insurance claims, forensic accountants verify claim legitimacy, helping insurers mitigate fraud.

- Risk Assessment and Management: By assessing internal controls, forensic accountants help organizations protect themselves against potential fraud.

*EDUCBA

Forensic Accounting Skills Needed in India

A unique set of skills that combine traditional accounting with investigative know-how are required. Here’s a look at the critical skills required:

- Analytical Skills: The ability to analyze financial data, recognize patterns, and identify red flags.

- Attention to Detail: Forensic accountants need to meticulously examine records and transactions to uncover discrepancies.

- Legal Knowledge: A working knowledge of Indian laws and regulations, such as the Prevention of Money Laundering Act (PMLA) and Companies Act, is essential.

- Communication Skills: Forensic accountants must convey complex findings to non-experts, including judges and attorneys.

- Data Analysis: In India, with digital transactions on the rise, familiarity with data analytics tools is a valuable asset for forensic accountants.

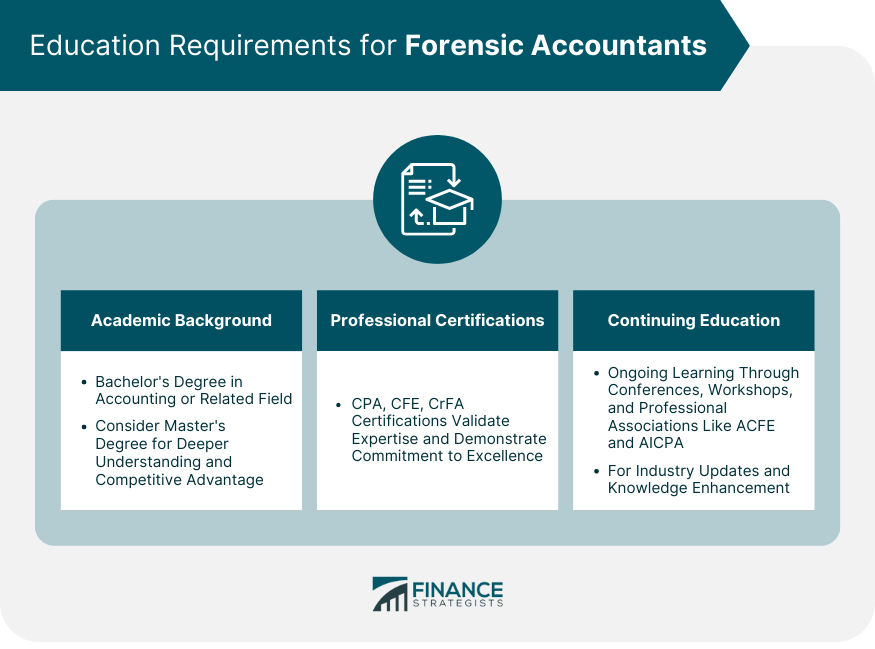

Educational Pathways: Forensic Accounting Courses and Certifications

The growing need for forensic accountants has led to several educational programs that include a forensic accounting syllabus in India. Pursuing a degree or certification provides the necessary foundation for a successful forensic accounting career.

*FinanceStrategists

Popular Forensic Accounting Courses and Certification in India

- Chartered Accountant (CA): A CA designation from ICAI is highly respected in India and often serves as the foundation for those interested in forensic accounting.

- Certified Forensic Accounting Professional (CFAP): Offered by the India Forensic Academy, CFAP is a specialized certification focusing on fraud detection and financial crime.

- Certified Fraud Examiner (CFE): This internationally recognized credential is valuable in India and focuses on fraud prevention, detection, and deterrence.

- Postgraduate Programs in Forensic Accounting: Institutes like the National Forensic Sciences University in Gandhinagar offer specialized postgraduate programs in forensic accounting and financial fraud investigation.

- MBA in Forensic Accounting: Some business schools offer an MBA with a focus on forensic accounting, combining business management with forensic investigation skills.

Career Opportunities in India

This role offers a broad range of career opportunities across various sectors. Here are some common forensic accounting jobs:

| Career Path | Description |

|---|---|

| Forensic Auditor | Works in organizations to examine financial documents for fraud. |

| Fraud Investigator | Specializes in identifying and preventing internal and external fraud. |

| Risk Manager | Assesses financial risks and advises on preventative measures. |

| Litigation Support Analyst | Assists in financial disputes and provides expert testimony. |

| Compliance Officer | Ensures organizational adherence to financial regulations. |

Conclusion: Why Forensic Accounting is a Future-Proof Career in India

With the expansion of financial regulations, corporate governance standards, and the complexity of financial crimes, forensic accounting is expected to continue growing in India. Professionals with strong analytical abilities, attention to detail, and the appropriate certifications are well-positioned for successful careers. From government bodies like the SFIO and ED to multinational corporations, the demand for forensic accounting expertise spans industries and job functions. For those interested in a challenging and rewarding career that combines finance, investigation, and law, forensic accounting is a compelling choice in the modern Indian job market.

For those interested in pursuing a forensic accounting career, now is the ideal time to explore certification programs, degree courses, and other educational pathways in this field.

Frequently Asked Questions

Yes, forensic audit is increasingly seen as a promising career in India. Given the rise in corporate fraud, financial crime, and regulatory scrutiny, forensic auditors play a crucial role in ensuring financial transparency and integrity. It is a well-compensated and respected field in India, especially in sectors such as finance, insurance, consulting, and government agencies like the Serious Fraud Investigation Office (SFIO) and the Reserve Bank of India (RBI).

The salary varies widely based on experience and location. Entry-level salaries typically start at around INR 5–8 lakhs per annum, with mid-career professionals earning between INR 10–15 lakhs, and senior professionals in major consulting firms or government roles earning significantly higher. International certifications or additional experience in forensic analysis can also enhance salary prospects.

Forensic accounting is a specialized branch of accounting focused on investigating financial fraud and providing litigation support. While Certified Public Accountant (CPA) certification is recognized globally and valued in forensic roles, it is not mandatory to be a CPA to work as a forensic accountant, especially in India. Indian forensic accountants often pursue qualifications like Chartered Accountant (CA) or Certified Forensic Accountant (CFA) or opt for certifications such as Certified Fraud Examiner (CFE) to enhance their expertise and credentials in this field.

A Chartered Accountant (CA) degree is one of the most sought-after qualifications for forensic accountants in India. It provides a strong foundation in accounting, auditing, and finance. Additionally, certifications like Certified Fraud Examiner (CFE) or a diploma in forensic accounting from reputed institutions can further boost career prospects. For those interested in deeper forensic specializations, an MBA in forensic accounting or a forensic-focused certification such as Cr.FA (Certified Forensic Accountant) can also be valuable.

Yes, the Big 4 accounting firms (Deloitte, PwC, EY, and KPMG) actively hire forensic accountants. They each maintain forensic investigation teams that handle a range of services, from fraud detection and anti-money laundering to digital forensics. These teams often consist of professionals from diverse backgrounds, including chartered accountants, legal experts, IT specialists, and data analysts. Each firm has its own set of requirements, often valuing candidates with strong analytical, legal, and technological skills.

Absolutely. Chartered Accountants (CAs) are well-suited for such roles due to their deep expertise in auditing, compliance, and financial analysis—skills that are critical in investigating fraud and financial misconduct. In India, many such roles, especially within the Big 4, actively seek CAs due to their rigorous accounting background and understanding of corporate finance and regulatory requirements.

Yes, KPMG provides comprehensive forensic accounting services, including fraud investigations, regulatory compliance, and dispute resolution. Their global forensic teams work across various industries, leveraging data analytics and forensic technology to detect irregularities and investigate cases of financial misconduct. KPMG’s forensic division plays a key role in helping clients navigate complex legal and regulatory environments.