Financial Analysis With AI: Unlocking New Possibilities in Finance

Table of Contents

- jaro education

- 25, November 2024

- 9:00 am

Artificial Intelligence (AI) has become the cornerstone of innovation across industries, and its impact on finance is profound. From streamlining operations to generating insights that drive decisions, AI financial analysis is redefining how we understand and manage finances. But what does this transformation look like, and what are its implications?

In this blog, we’ll explore the key AI applications in finance, how they benefit financial planning and analysis, and the ethical considerations that come with using generative AI in this field.

Traditional vs. AI-Driven Financial Analysis

| Aspect | Traditional Methods | AI-Driven Methods |

|---|---|---|

| Data Processing | Manual, time-consuming | Automated, real-time |

| Accuracy | Prone to human error | High accuracy with minimal errors |

| Scalability | Limited to smaller datasets | Capable of processing massive datasets |

| Decision-Making | Based on historical data and intuition | Data-driven, predictive insights |

| Fraud Detection | Reactive (after fraud occurs) | Proactive (real-time anomaly detection) |

| Cost Efficiency | High operational costs | Long-term cost savings |

This table highlights why businesses are rapidly shifting toward AI financial analysis tools for enhanced efficiency and accuracy.

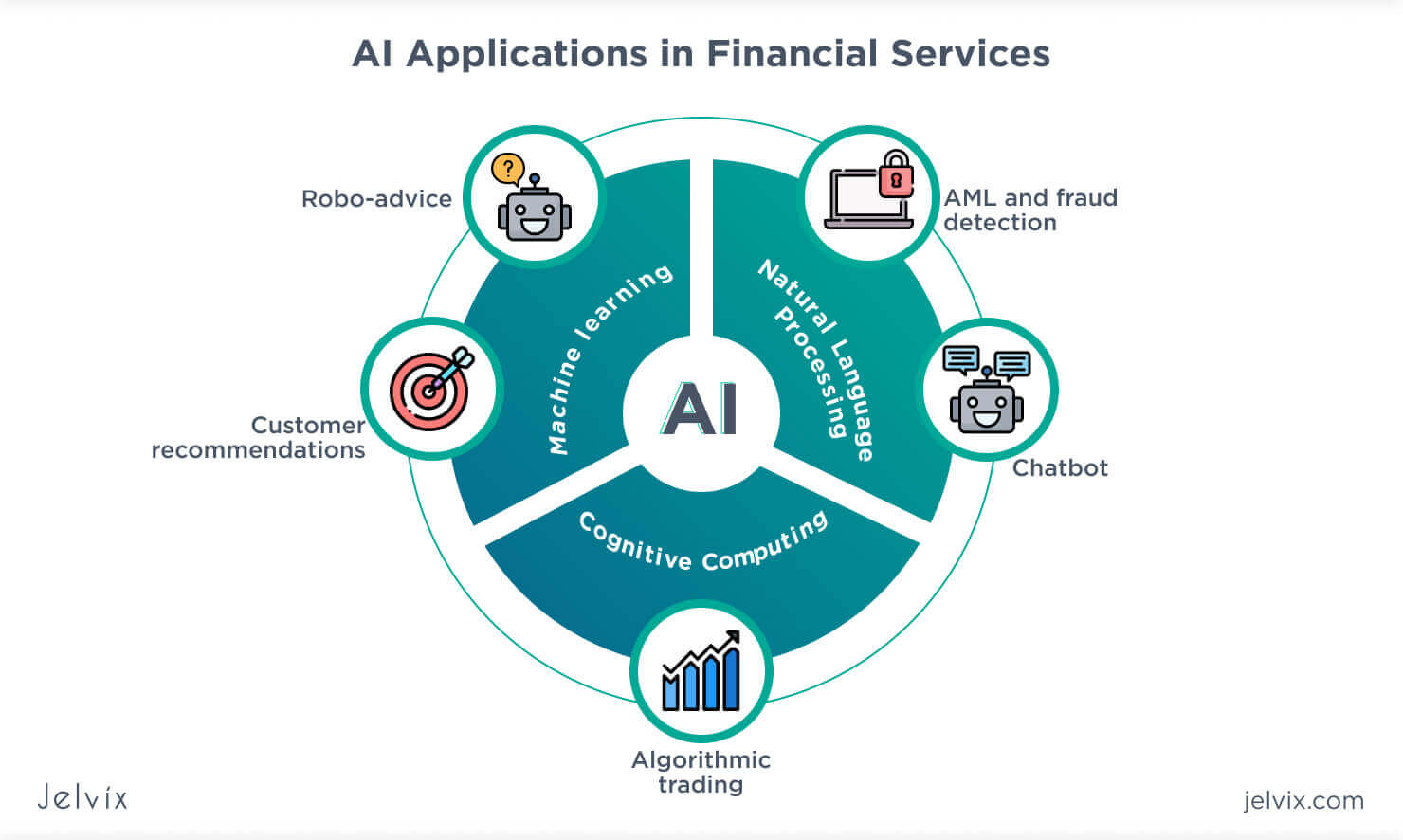

The Role of AI in Financial Services

AI in financial services goes far beyond automating repetitive tasks; it’s revolutionizing everything from fraud detection to customer service. Some key areas include:

1. Risk Management

Risk is inherent in finance, but AI applications enable institutions to predict and mitigate risks effectively. For example, machine learning models analyze market volatility and customer creditworthiness, enabling better loan approvals and investment strategies.

2. Fraud Prevention

Traditional fraud detection methods often rely on predefined rules, which can miss novel fraud tactics. AI detects anomalies in real-time, identifying fraudulent activities even before they cause significant damage.

3. Customer Insights and Personalization

AI tailors financial products to individual customer needs. Robo-advisors, for example, provide personalized investment recommendations based on user profiles, making wealth management accessible to everyone.

*Jelvix

Benefits of AI in Financial Analysis

AI financial analysis offers transformative benefits that make it indispensable for modern businesses. Let’s summarize these benefits:

| Benefit | Description |

|---|---|

| Enhanced Accuracy | Minimizes errors by automating calculations and data processing. |

| Real-Time Insights | Provides instant analysis and decision-making capabilities. |

| Cost Reduction | Cuts down operational expenses by automating routine tasks. |

| Scalable Solutions | Can handle growing data volumes without compromising performance. |

| Improved Risk Management | Detects potential risks and fraud proactively. |

| Faster Decision-Making | Delivers actionable insights quickly, allowing businesses to adapt to changing market conditions. |

These benefits highlight how AI applications in finance are not just a luxury but a necessity in today’s competitive landscape.

Use Cases: AI Applications in Finance

To truly understand the transformative power of AI, let’s look at some real-world use cases:

| AI Application | Example | Impact |

|---|---|---|

| Robo-Advisors | Betterment, Wealthfront | Democratized investment advice for retail investors. |

| Credit Scoring Models | Zest AI, FICO | Faster, more accurate assessments of creditworthiness. |

| Predictive Analytics | Predicting stock prices, market trends | Helps investors and businesses make informed decisions. |

| Fraud Detection Systems | PayPal’s Fraud Prevention Program | Reduced fraudulent transactions, saving billions annually. |

| Portfolio Optimization Tools | BlackRock’s Aladdin | Optimized asset allocation and risk management. |

These examples underscore the versatility of AI financial analysis tools in improving various aspects of the financial ecosystem.

*advansappz

How AI Enhances Financial Planning and Analysis

Financial planning is a critical function for businesses and individuals alike. AI financial analysis takes it to a new level by addressing key challenges such as data overload, forecasting inaccuracies, and manual inefficiencies.

Here’s how AI transforms financial planning and analysis (FP&A):

- Budgeting and Forecasting: AI models analyze historical data to predict future financial trends, ensuring accurate budget allocation.

- Performance Monitoring: AI tools track KPIs in real time, providing actionable insights for strategy adjustments.

- Scenario Planning: AI simulates various scenarios to help businesses prepare for uncertainties, such as market downturns or economic shifts.

- Cost Optimization: By analyzing spending patterns, AI identifies areas for cost reduction without compromising performance.

What Are Some Ethical Considerations When Using Generative AI?

As promising as AI is, its implementation raises ethical questions. What are some ethical considerations when using generative AI in finance? Let’s explore:

1. Data Privacy

2. Algorithmic Bias

AI systems are only as unbiased as the data they are trained on. If the training data is biased, the outcomes can be discriminatory.

3. Transparency

AI algorithms can sometimes act as black boxes, making it hard to understand how decisions are made. Transparency is crucial, especially in areas like credit scoring.

4. Accountability

When AI makes a mistake—such as denying a loan or approving a risky investment—determining accountability can be challenging.

Addressing these concerns is essential to ensuring the responsible use of AI in financial services.

The Future of AI Financial Analysis

-

- Hyper-Personalization: AI will enable even more tailored financial solutions based on real-time user data.

- Blockchain Integration: AI and blockchain will work together to enhance transaction security and transparency.

- Voice-Powered Financial Tools: Voice-activated assistants will simplify financial planning and analysis for users.

- Global Adoption: As AI tools become more affordable, smaller businesses and startups will also embrace them.

Conclusion

The transformative power of AI in finance is undeniable. By leveraging financial analysis tools, businesses can enhance efficiency, reduce costs, and make data-driven decisions. However, adopting AI also requires addressing ethical challenges to ensure fairness and accountability.

The key takeaway? The benefits of AI are too significant to ignore. Organizations that embrace AI applications in finance today will lead the charge in tomorrow’s economy.

From financial planning and analysis to fraud detection, AI financial analysis is not just about adopting technology; it’s about creating a smarter, more resilient financial ecosystem. As the industry evolves, the question is not whether to use AI but how to use it responsibly.

Frequently Asked Questions

Financial analysis is the evaluation of an organization’s financial data to make informed decisions about its performance, stability, and potential for growth. It involves assessing key aspects such as:

-

- Profitability: Measuring a company’s ability to generate profits.

- Liquidity: Understanding whether the company can meet its short-term obligations.

- Efficiency: Evaluating how effectively resources are being used.

- Solvency: Analyzing the company’s ability to meet long-term debts and financial commitments.

- Market Performance: Reviewing stock performance and market trends (for publicly traded companies).

The five essential components of financial analysis include:

-

- Revenue Analysis: Examines income sources and trends to determine the company’s ability to generate revenue.

- Profitability Ratios: Includes metrics like gross profit margin, net profit margin, and return on equity (ROE).

- Liquidity Ratios: Focuses on the company’s ability to cover short-term liabilities (e.g., current ratio, quick ratio).

- Efficiency Ratios: Analyzes how effectively the company utilizes assets (e.g., inventory turnover, asset turnover ratio).

- Leverage (Solvency) Ratios: Assesses the company’s financial structure and debt management (e.g., debt-to-equity ratio).

There are various approaches to analyzing financial statements. The five primary methods include:

-

- Vertical Analysis: Compares line items as a percentage of a base figure (e.g., sales or total assets) to understand the relative significance of each element.

- Horizontal Analysis: Looks at financial data over time to identify trends or changes across accounting periods.

- Ratio Analysis: Uses financial ratios to assess performance, liquidity, profitability, and solvency.

- Trend Analysis: Focuses on identifying long-term patterns or shifts in key metrics over multiple periods.

- Comparative Analysis: Compares financial performance with industry peers or standards to evaluate competitiveness.

Financial analysis can be categorized into three broad types based on its purpose:

-

- Internal Analysis: Conducted by the organization’s management to evaluate internal operations, identify inefficiencies, and plan strategies.

- External Analysis: Performed by external stakeholders, such as investors or creditors, to assess the organization’s financial health and investment potential.

- Horizontal and Vertical Analysis: Often combined, this type of analysis examines historical trends and percentage breakdowns to gain a complete picture of financial performance.

1 thought on “Financial Analysis With AI: Unlocking New Possibilities in Finance”

This blog brilliantly explains the transformative role of AI in financial analysis. Insightful and a must-read for finance professionals!