Subjects in Bcom Accounting and Finance: Everything You Need to Know

Table of Contents

Building the Foundation for Financial Success: B.Com in Accounts and Finance

The world of commerce offers boundless opportunities for those equipped with the right knowledge and skills. A Bachelor’s degree in Accounts and Finance is your compass to navigate this thriving industry. From managing financial operations to interpreting economic trends, this program prepares you to meet the demands of the modern business landscape.

Whether your ambition lies in climbing the corporate ladder, managing business finances, or launching your venture, the Bcom degree lays a solid foundation for achieving your career goals. Take the first step today and unlock your potential in commerce!

*Leverageedu.com

BCom Accounting and Finance Overview

Bachelor of commerce in accounting and finance is an undergraduate degree that aspirants can pursue after the completion of their 10+2. The minimum mark required to gain admission into this course is 50% from a recognized university. However, the scores may vary from one college to another The average tuition fees for BCom accounting and finance range from INR 1 lakhs to INR 10 lakhs. This program typically covers the core concepts of finance management by businesses, recording transactions, and making smart financial decisions. Additionally, after the successful completion of this course, students will be able to handle complex financial data, prepare analysis reports, and contribute to the financial making process of an organization.

Difference between finance and accounting: Which one is better?

Dealing with both accounting and finance can be confusing as both fields focus on financial data and money. However, to avoid any confusion, let us understand the difference between both subjects.

| Aspect | Accounting | Finance |

|---|---|---|

| Focus | Documenting and reporting financial transactions | Management and analysis of financial resources |

| Purpose | Ensuring accuracy, transparency, and compliance | Strategic decision-making and maximization of value |

| Main Activities | Preparing financial statements, bookkeeping | Budgeting, investments, risk management, financial planning |

| Key Outputs | Financial statements (Balance Sheet, Income Statement) | Investment analysis, financial forecasts, and strategies |

| Main users | Government, auditors, business owners, tax authorities | Business managers, investors, financial analysts |

| Regulatory Influence | Highly regulated by accounting standards (GAAP/IFRS) | Business managers, investors, financial analysts |

| Educational Path | Typically involves certifications like CPA | Often requires advanced degrees or certifications like CFA |

To choose a specific subject, students need to decide on certain factors such as their interests, aspirations, job roles, and career scope.

BCom Accounting and Finance Subjects

BCom accounting and finance covers various fundamental subjects necessary for an aspirant to make a successful career in this field. This degree program is divided into a total of 6 semesters which are as follows.

Sem 1:

| BCom Accounting and Finance Subjects - Sem 1 |

|---|

| Financial Accounting |

| Basics of Retail Marketing |

| Language and Communication skill level - I |

| Marketing |

| Allied Business Statistics |

| Elective I |

| Elective II |

The BCom accounting and finance degree program consists of a wide array of subjects aimed at establishing a robust foundation in business and financial management. The Financial Accounting subject emphasizes the processes of recording, analyzing, and interpreting financial transactions. In contrast, the Basics of Retail Marketing subject introduces essential concepts such as consumer behavior and retail strategies. The Language and Communication Skill Level – I subject is designed to enhance professional communication abilities, which are vital for success in business. The Marketing subject explores aspects of market research, promotion, and customer relationship management, which are further supported by the analytical tools taught in Allied Business Statistics, covering data analysis, probability, and forecasting techniques. Furthermore, Elective I and Elective II provide students with the opportunity to focus on specific areas of interest, allowing them to develop specialized knowledge and align their educational pursuits with their career goals.

Sem 2:

| BCom Accounting and Finance Subjects - Sem 2 |

|---|

| Business Environment |

| Basics of Business Insurance |

| Language and Communication skill level - I |

| Advanced Financial Accounting |

| Elements of Operations Research |

| Elective I |

| Elective II |

The curriculum for Semester 2 of the Bcom accounting and finance degree program is structured to enhance students’ comprehension of fundamental business and financial principles. The subject Business Environment examines the various internal and external factors that affect business operations. In Basics of Business Insurance, students are introduced to the principles of risk management and insurance that are pertinent to businesses. The subject Language and Communication Skill Level – I aims to improve both linguistic and professional communication abilities. Advanced Financial Accounting delves into intricate subjects such as partnership and branch accounting, while Elements of Operations Research provides students with analytical methods to refine business processes. Furthermore, Elective I and Elective II offer students the opportunity to further specialize, allowing them to align their expertise with their personal interests and career aspirations.

Sem 3:

| BCom Accounting and Finance Subjects - Sem 3 |

|---|

| Business Laws |

| Corporate Accounting |

| Indian Economy - I |

| Personality Enrichment Level - I |

| Entrepreneurial Development |

| Banking Theory Law & Practice |

| Entrepreneurial Development |

| Banking Theory Law & Practice |

| Environmental Studies |

The curriculum for Semester 3 of the BCom accounting and finance degree program is designed to enhance both business knowledge and skills. The subject Business Laws examines the legal structures governing business activities, whereas Corporate Accounting focuses on the financial statements of corporations. The subject Indian Economy – I investigate prevailing economic trends, and Personality Enrichment Level – I aims to cultivate essential soft skills. Additional subjects such as Entrepreneurial Development, Banking Theory Law & Practice, and Environmental Studies contribute to a comprehensive educational experience.

Sem 4:

| BCom Accounting and Finance Subjects - Sem 4 |

|---|

| Advanced Corporate Accounting |

| Financial Services |

| Indian Economy - II |

| Basics of Computer Application |

| Principles of Management |

| Business Communication |

| Environmental Studies |

The Semester 4 curriculum for the BCom accounting and finance degree program focuses on sophisticated business and financial principles. The subject Advanced Corporate Accounting delves into intricate corporate financial methodologies, whereas Financial Services focuses on the financial sector’s impact on the economy. Indian Economy – II further advances economic analysis, and Basics of Computer Application provides foundational IT competencies. Additionally, Principles of Management and Business Communication enhance managerial and communication skills, while Environmental Studies promotes an understanding of sustainability.

Sem 5:

| BCom Accounting and Finance Subjects - Sem 5 |

|---|

| Elements of Cost Accounting |

| Financial Management |

| Value Education |

| Value Education |

| Practical Auditing |

| Income Tax Law & Practice - I |

| Portfolio Management |

The curriculum for Semester 5 of the BCom accounting and finance degree program provides students with vital skills in finance and auditing. The subject of Elements of Cost Accounting emphasizes the analysis of costs, whereas Financial Management addresses the principles of sound financial decision-making. Value Education promotes ethical standards, Practical Auditing examines the procedures involved in auditing, Income Tax Law & Practice – I investigate the basics of taxation, and Portfolio Management focuses on strategies for investment.

Sem 6:

| BCom Accounting and Finance Subjects - Sem 6 |

|---|

| Adv.Cost Accounting |

| Working Capital Management |

| Extension Activities |

| Management Accounting |

| Income Tax Law & Practice - II |

| Capital Markets |

The Semester 6 curriculum of the BCom accounting and finance degree program focuses on advanced financial and managerial concepts. Advanced Cost Accounting deepens cost analysis techniques, while Working Capital Management emphasizes liquidity optimization. Management Accounting enhances decision-making skills, Income Tax Law & Practice – II covers advanced taxation, Capital Markets explores financial securities, and Extension Activities promote practical learning and social engagement.

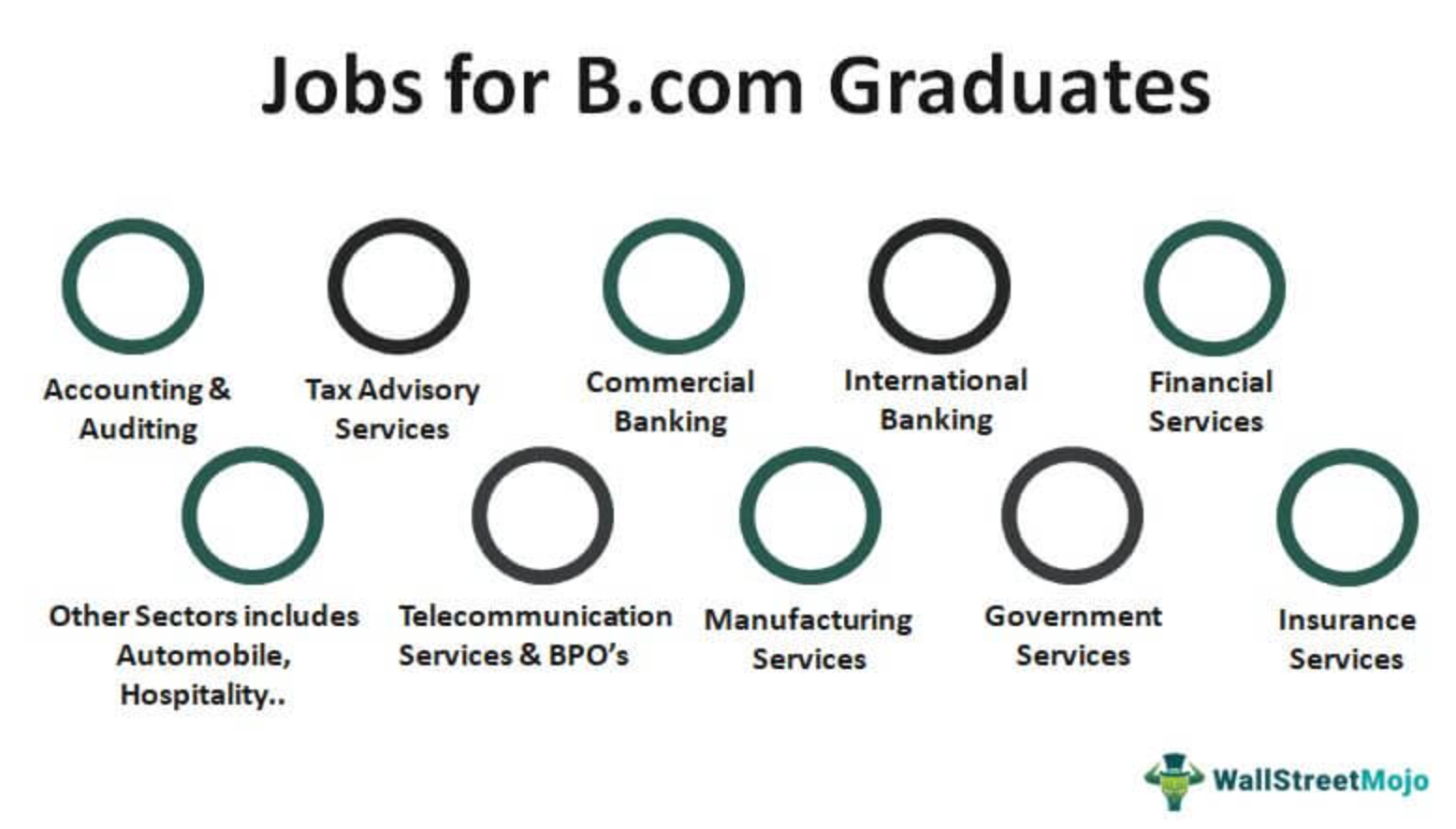

Bcom Accounting and Finance Job Opportunities

Graduates holding a BCom in Accounting and Finance are presented with a multitude of career prospects across various sectors, including accounting, auditing, taxation, banking, and financial services. They may explore job roles such as Accountant, Financial Analyst, Tax Consultant, Investment Banker, and Auditor. Additionally, students may consider pursing higher education such as Chartered Accountant (CA), Cost and Management Accountant (CMA), or Master of Business Administration (MBA).

Online BCom Accounting and Finance Degree Program

An online degree in Bachelor of Accounting and Finance program presents a cost-effective and adaptable choice for individuals aiming for a high-quality education without the limitations of geographical boundaries. This course enables students to manage their academic pursuits alongside professional or personal obligations, while also providing access to knowledgeable instructors and valuable resources.

Get started with an Online Bcom degree Manipal University

Manipal University Jaipur is recognized by the UGC and accredited by NAAC, AICTE, WES, and ICAS. The institution has nurtured a legacy of inspiring change-makers, impressive alumni who have impacted change worldwide, faculty members who are at the forefront of their fields, world-class infrastructure and a cutting-edge digital campus. Delve into the burgeoning world of commerce with an Online Bachelor of Commerce (BCom) programme designed by Manipal University. Students can equip with the right managerial skills to build key competencies required to succeed in the field of commerce. This interactive online degree facets you with knowledge of accounting principles, export and import laws, economic policies, and other aspects that influence trade and business. You will learn how to analyze and interpret information and use interdisciplinary approaches to solve real-world business problems and create new business opportunities.

Conclusion

There are multiple BCom accounting and finance subjects that will help the students understand the curriculum in an in-depth manner. The knowledge that one gains out of these subjects is comprehensive and provides enough understanding to lay a good foundation further. It is important to select the right specialization so that it will help the students to pick a job in finance that better suits their interests.

Frequently Asked Questions

Accounting in Bcom provides an introduction to fundamental accounting principles, encompassing financial transactions, the preparation of ledgers, and the creation of financial statements.

Yes, BCom Accounting and Finance is an excellent degree for those seeking a strong foundation in financial management, accounting principles, and business strategies. It offers diverse career opportunities in fields like auditing, taxation, banking, and corporate finance. The degree also provides a solid base for advanced studies like CA, CFA, or MBA

BCom accounting is challenging but it can be effectively managed through regular study and a solid grasp of the underlying concepts, as it integrates theoretical knowledge with practical applications.

Yes, BCom accounting and finance paves the way for fulfilling careers in areas such as accounting, auditing, financial analysis, and taxation, with significant growth opportunities across various industries.

Luca Pacioli, an Italian mathematician, is recognized as the pioneer of accounting for his introduction of double-entry bookkeeping during the 15th century.