Leveraged Buyouts: Understanding LBOs and their Valuation

Table of Contents

- jaro education

- 14, July 2023

- 4:00 pm

Leveraged buyouts (LBOs) are a prominent feature of the financial ecosystem, with significant implications for companies and investors. This article aims to provide a deep understanding of LBOs and their valuation, shedding light on the intricacies of this investment strategy.

The Professional Certificate Programme in Investment Banking offered by IIM Kozhikode is designed to equip participants with the essential theoretical and conceptual tools in investment banking. This course is indispensable for individuals seeking a comprehensive understanding of leveraged buyouts (LBOs) and their valuation. By undertaking this programme, participants will acquire the knowledge and skills necessary to navigate the intricacies of LBOs, assess their financial worth, and comprehend the underlying principles and strategies involved.

Leveraged Buyouts: Understanding LBOs and their Valuation

A leveraged buyout (LBO) is a transaction in which a company or group of investors acquires another company using a significant amount of borrowed funds or debt. The acquired company’s assets serve as collateral for the debt; hence the term “leveraged.” The goal of an LBO is to generate a return on investment that exceeds the cost of borrowing, thereby creating value for the acquiring party.

LBOs have gained popularity due to their potential for high returns, but they also come with increased risks. Proper valuation is crucial in LBOs to ensure the acquisition price aligns with the target company’s value and potential future earnings. It is one of the critical factors in successfully executing an LBO is proper valuation. Valuation plays a crucial role in determining the acquisition price that an investor is willing to pay for the target company. It involves assessing the company’s current value and its potential future earnings and cash flows.

The Process of Leveraged Buyouts

LBOs have emerged as a lucrative strategy in corporate finance, offering a unique pathway for investors to acquire control over a company using a significant amount of borrowed funds. Here are the steps to successfully culminate the process.

1. Identifying a Target Company

The first step in an LBO is identifying a suitable target company. This involves extensive research and analysis of the target company’s financials, industry dynamics, growth prospects, and market position. Successful LBOs largely focus on companies with stable cash flows and growth potential.

2. Assembling the Deal Team

Once a target company is identified, the acquiring party assembles a deal team of professionals like investment bankers, lawyers, accountants, and consultants. The deal team is crucial in conducting due diligence, negotiating the transaction, and structuring the financing.

3. Conducting Due Diligence

Due diligence is a comprehensive examination of the target company’s financial, legal, and operational aspects. It involves reviewing financial statements, legal contracts, customer relationships, and potential risks or liabilities. The goal is to thoroughly understand the target company’s operations and uncover any hidden issues.

4. Negotiating the Transaction

Once due diligence is complete, negotiations commence between the acquiring party and the target company’s shareholders or management. This stage involves determining the purchase price, deal structure, and transaction terms. Skilled negotiation ensures a mutually beneficial agreement for all parties involved.

5. Structuring the Financing

The financing structure of an LBO typically involves a combination of equity and debt. The acquiring party contributes a certain percentage of the purchase price through equity. At the same time, the remaining funds are raised through various debt instruments such as bank loans, high-yield bonds, or mezzanine financing. The target company’s assets secure the debt portion.

6. Closing the Deal

After finalising the transaction and obtaining the necessary approvals, the deal is closed. The acquiring party assumes control of the target company, and the agreed-upon purchase price is paid to the selling shareholders.

Valuation Methods in Leveraged Buyouts

Valuing a company accurately is crucial in LBOs to ensure the acquisition price is reasonable and aligns with the target company’s financial performance and potential. Several valuation methods are commonly used in LBOs. Let’s explore some of these methods.

1. Earnings Multiple

The earnings multiple is a method that calculates the net worth of a company based on a multiple of its earnings. This multiple is typically derived from comparable companies or transactions in the same industry. The target company’s earnings, such as EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortisation), are multiplied by the earnings multiple to know the estimated value.

2. Discounted Cash Flow (DCF)

The discounted cash flow method estimates a company’s worth by projecting its future cash flows and discounting them back to their present value. This method considers the time value of money, as future cash flows are worth less than immediate cash flows. DCF analysis requires making assumptions about future cash flow growth rates and the discount rate, representing the required return rate for the investment.

3. Comparable Company Analysis

Comparable company analysis involves benchmarking the target company against similar publicly traded companies. Key financial ratios like price-to-earnings (P/E), price-to-sales (P/S), or enterprise value-to-EBITDA (EV/EBITDA) are used to determine the target company’s valuation multiples.

4. Asset-Based Valuation

Asset-based valuation calculates the value of a company based on its net assets. This method considers the target company’s tangible assets (e.g., property, plant, and equipment) and intangible assets (e.g., patents, trademarks) minus its liabilities. Asset-based valuation is commonly used when a company’s liquidation value exceeds its intrinsic or going-concern value.

5. Leveraged Buyout (LBO) Model

The LBO model is a comprehensive financial model designed to analyse and value leveraged buyouts. It considers factors such as the purchase price, financing structure, projected cash flows, debt repayments, and exit strategies. The LBO model enables the acquiring party to assess the potential returns and risks associated with the transaction.

Factors Influencing Successful LBOs

Many factors are associated with the success of leveraged buyouts. Understanding these factors is essential for making informed investment decisions. Here are some of the key factors influencing LBOs’ success.

1. Cash Flow Stability

Companies with stable and predictable cash flows are often preferred targets for LBOs. Reliable cash flow generation provides assurance that the debt obligations can be met, reducing the risk of default. Industries with recurring revenue streams, such as utilities or subscription-based services, are particularly attractive for LBOs.

2. Growth Potential

Identifying target companies with growth potential is vital in LBOs. Acquirers look for companies operating in expanding markets with opportunities to increase market share, introduce new products or services, or expand into new geographic regions. Growth potential enhances the prospects of generating attractive returns on investment.

3. Operational Efficiency

Companies with strong operational efficiency and the potential for improvement through cost reduction or operational restructuring are appealing to LBO investors. Streamlining operations, optimising supply chains, and enhancing productivity can lead to increased profitability and value creation

4. Strong Management Team

A capable and experienced management team is crucial for executing an LBO successfully. The management team’s ability to implement strategic initiatives, drive growth, and navigate challenges is vital for maximising the target company’s value. LBO investors often collaborate closely with the management team to capitalise on their expertise.

5. Appropriate Capital Structure

The capital structure of an LBO must strike the right balance between equity and debt. Too much debt increases the risk of financial distress and may hinder the target company’s ability to invest and grow. On the other hand, a higher equity component reduces leverage but may impact the potential returns. Finding an optimal capital structure is essential for a successful LBO.

6. Exit Strategy

Having a well-defined exit strategy is crucial in LBOs. Acquirers aim to exit their investments and realise their returns within a specific timeframe. Common exit strategies include selling the company to a strategic buyer, conducting an initial public offering (IPO), or merging with another company. The exit strategy should align with the target company’s growth trajectory and market conditions.

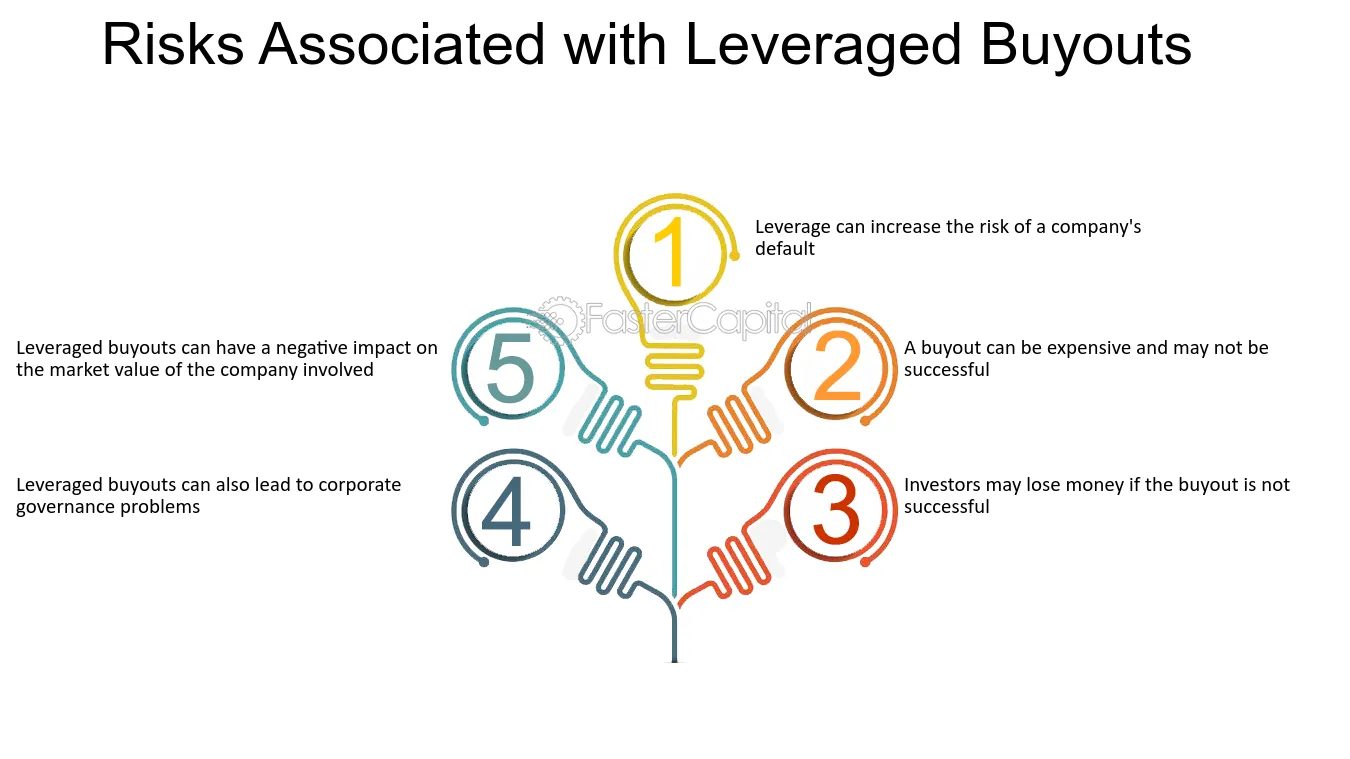

Risk Factors Related to LBOs

Even though LBOs are beneficial in investment banking, there are certain risks associated with them. Below are the risks it holds for equity and debt holders.

Risks for Equity Holders

1. Operating Risk

Equity holders face the risk associated with the company’s operational performance and its ability to generate profits.

2. Financial Leverage Risk

High levels of debt result in fixed interest costs, which can lead to default if not paid. The equity value is more sensitive to small changes in enterprise value (EV) when the company is highly leveraged, while the debt value remains constant.

Risks for Debt Holders

Debt holders bear the risk of default, especially when a company has high leverage. However, as they have senior claims on the company’s assets, they are likely to recover at least a portion, if not the full amount, of their investment, even in the event of bankruptcy.

Conclusion

Investors and business experts can evaluate possible leveraged buyout prospects with greater knowledge by knowing the basics of LBOs, their valuation methodologies, and related risks. Having this basic understanding is a great place to start when engrossing yourself in the exciting world of corporate finance and private equity.

To understand leverage buyouts in further detail, the IIM Kozhikode investment banking programme can be an effective resort. You can submit an application through Jaro Education and be a part of this imminent course. The 12-month programme in investment banking is offered online and includes specialised lectures by IIM faculty with extensive industry experience. Participants will learn the skills and knowledge necessary to confidently enter the investment banking business by the end of the programme. This programme enables individuals to analyse the core activities of investment banks, comprehend the unique aspects and challenges of the industry, and foster an understanding of corporate finance.

![Best-IIM-Online-Courses-with-Certification-[2025]](https://jaro-website.s3.ap-south-1.amazonaws.com/2025/04/Best-IIM-Online-Courses-with-Certification-2025-1024x576.webp)