A Comprehensive Guide on Taxation in India

Table of Contents

- jaro education

- 26, April 2024

- 1:11 pm

Taxes are the amount that is deducted directly or indirectly from an individual or a business organization for the ultimate purpose of expanding society. The development of a nation highly depends on the responsibility of the citizens to pay the tax amount sincerely. Without the tax amount, the government could not perform its duties to improve the nation’s development. Hence, every individual needs to pay the taxed amount sincerely.

In this blog, we will discuss various aspects of taxation in India, from its types to its importance.

Taxation in India: Overview

Taxes are the government’s primary and most significant source of funding, therefore taxation in India is regarded as a very important thing. The nation’s development is financed by the government through a variety of initiatives. There are three federal tiers to the well-organized Indian tax system.

Following the federal structure, India’s taxation system is segregated into three tiers: central, state, and local. The Central Board of Direct Taxes (CBDT) oversees direct taxation, which includes income tax, corporate tax, and capital gains tax. On the other hand, the Central Board of Indirect Taxes and Customs (CBIC) administers indirect taxes such as goods and services tax (GST), excise duty, and customs duty. State governments have the authority to levy taxes on items like property, agriculture, and value-added tax (VAT). Local bodies impose property and professional taxes to fund their administrative functions, thereby ensuring a robust revenue structure.

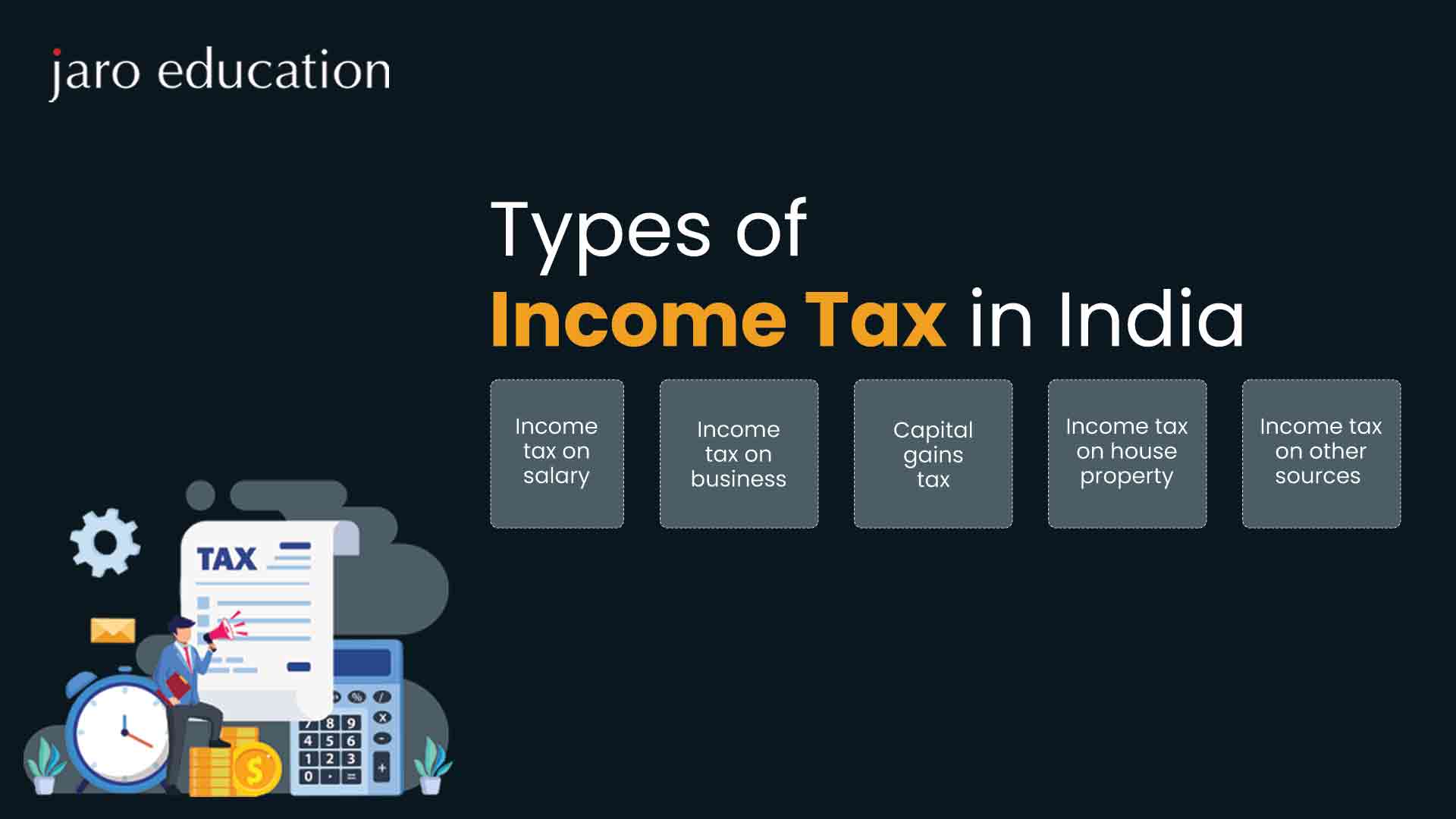

Types of Taxes in India

Generally, taxation in India can be classified into two broad categories: direct taxes and indirect taxes.

Direct taxes

The concept of individual ability to pay, which states that people or entities with higher incomes and access to resources should pay more taxes, is the basis for the imposition of direct taxes. The direct regulations are written in a way that makes taxes an instrument of national income redistribution. Instead, they don’t go through any middlemen and are imposed straight on the earnings of people, businesses, and other entities. In general, income tax, capital gains tax, and corporation tax are considered the three most important forms of direct taxes in India. These taxes are important sources of income for the government and are vital for funding public projects and fostering economic growth.

Besides the three most important forms, an individual must pay the government several forms of direct taxes. Here are some different forms of direct taxes in India:

1. Dividend Distribution Tax

When a company declares and distributes dividends, the company must pay a tax known as the Dividend Distribution Tax (DDT). Before paying dividends to shareholders, a corporation must subtract the DDT tax from its earnings or dividends. Furthermore, DDT is a requirement for all foreign and local companies doing business in India.

2. Capital Gains Tax

A tax known as capital gains tax is levied on earnings made by an individual via the sale of assets. The tax is not levied while the asset is still in the possession of the investor; rather, it is only applied once the item has been turned into cash. A capital gain tax is imposed when an individual or business entity decides to sell an asset for a profit.

3. Estate Tax

An estate tax is imposed by the government on assets that a deceased person leaves behind that are valued at more than a specific amount. Estate taxes are typically levied on assets bequeathed to heirs and do not apply to the transfer of any property to any living member of the family.

4. Income tax

Taxes levied on an individual’s or business’s yearly income during a fiscal year are known as income taxes. The Income Tax Act of 1961 provides guidelines for the assessment, collection, and computation of income taxes, and it governs the entire taxation system in India. To reduce the tax obligation for a particular financial year, the Indian Income Tax Act consists of several deductions and exemptions.

5. Securities Transaction Tax

When securities such as stocks, mutual funds, and derivatives are bought and sold on authorized stock exchanges in India, a certain kind of tax is levied, known as securities transaction tax (STT). Since it is levied directly on the transaction value of securities, the STT is classified as a direct tax. Essentially, this means that the STT adds to the cost of the transaction for both buyers and sellers. The government sets the STT rate, which is subject to periodic adjustments. Depending on the transaction amount, either the seller or the buyer of securities is in charge of paying the STT.

6. Corporate Tax

This type of direct tax is paid as a result of the money received from the exchange of investments or assets. Capital assets include investments in houses, farms, bonds, stocks, companies, and many more. Corporate taxes are further categorized as either long-term or short-term, depending on how long they are held. All assets that are sold within 3 years of purchase are considered short-term profits, whereas the sale of properties that have been held for more than 3 years are identified as long-term assets.

Indirect Taxe

A tax levied by the government on products and services is passed off as an indirect tax. When a customer buys a thing or service, it is gathered by the producers or vendors of such goods and services and then given to the government. Frequently, they are already included in the cost of products and services. Excise taxes, transaction taxes, and consumption taxes are other names for indirect taxes. Compared to direct taxes, indirect taxes are regressive as they are not calculated as a percentage based on the individual’s income. Additionally, no reimbursement is given for indirect taxes.

There are several forms of Indirect taxes, but the most important ones are the goods and service tax (GST) and excise duty taxes.

1. Excise Duty Tax

The manufacturing, licensing, and sale of products fall under certain taxation payments, and the tax levied on them is known as excise duty tax excise duties. Excise duty is an indirect tax that manufacturers have to pay to the Government of India. It is charged on items made within the nation and not goods imported from different countries.

2. Goods and Sevices Tax (GST)

India’s indirect tax, known as GST, is levied on the distribution of particular goods and services. It was enacted to take the place of many other indirect taxes, such as the excise duty, purchase tax, value-added tax (VAT), and service tax. This taxation scheme, which is imposed across India, aims to prevent the other indirect taxes from cascading on top of one another.

Recent Reforms in Taxes

Taxpayers have been anxiously awaiting some tax relief from the Union Budget 2023 in the face of growing inflation. Consequently, larger Section 80C deductions, higher house loan repayment deductions, and other items were among the predictions for Budget 2023. One of the most anticipated and widely supported changes in Budget 2023 concerned income tax slabs to encourage economic growth in the nation. After all, it has been almost ten years since the income tax slabs were last modified.

- An increase in the tax exemption threshold for leave encashment upon retirement for non-government employees was proposed in the Budget 2023.

- As part of the current Union Budget, the Finance Minister suggested lowering the maximum surcharge rate from 37% to 25%.

- Section 87A of the Income Tax Act used to provide a refund for taxpayers earning ₹5 lakh or more annually. A proposal to raise the threshold to ₹7 lakhs was made by the Finance Minister in the Union Budget 2023.

- The TDS on online winnings would be withheld at a rate of thirty percent, according to a new regulation that the Center proposed. TDS was only imposed when wins exceeded Rs 10,000 in a fiscal year up to March 31, 2023. The new law states that to get an income tax refund; taxpayers must file an ITR if the amount of tax paid exceeds their taxable income.

- Capital gains on the sale of residential property are subject to a maximum deduction of Rs 10 crore, set by the government of India.

*Business Today and Bajaj Finserv Market

Why Do We Need To Pay Tax?

The development of a nation is based on its taxpayers and the taxes they pay to support the government in running the nation. The tax amounts are used for various purposes, such as supporting national security, creating new welfare programs, and many more. A nation’s ability to prosper economically and fairly depends on its tax system.

Here are some of the important reasons explaining why every responsible citizen of India should be able to pay their taxes:

1. Development of the Society

The nation’s healthcare system is improved with the help of a sizable portion of tax revenue. Certain government hospitals provide medical care for free or at a low cost. The only reason government hospital service has improved over the years is that taxpayers have made significant improvements to the quality of care they receive.

Similarly, some government schools charge very little for the children’s basic education. In addition to the development of hospitals and schools, a tremendous amount is spent on the infrastructure and strengthening the defense of our country. The amount contributed by the taxpayers ultimately aids in the development process of turning the nation into becoming stronger and wealthier.

2. Supporting the Entire Population

The Indian government receives the majority of its revenue from income tax. The development of our country will be adversely affected, and social breakdown may ensue if individuals begin to view income tax as a burden and refuse to pay the same. It is extremely expensive to manage a whole nation, particularly one as big and populous as ours. The government can carry out civic activities thanks to the taxes we pay. In short, the government of India would not be able to rule the nation if there were no taxes.

Conclusion

The taxation system in India is quite complicated but is also essential for both social welfare programs and the country’s economic growth. India has undergone substantial modifications throughout the years with the goals of streamlining tax legislation, improving compliance, and promoting economic expansion. While initiatives to increase the tax base have attempted to make the system more egalitarian, the advent of the GST simplified indirect taxation.

2 thoughts on “A Comprehensive Guide on Taxation in India”

Keep up the great work! Thank you so much for sharing a great posts.

Thank you for your generous comment! It’s great to hear that the post was valuable to you.