A Complete Guide To Taxes in India

Taxes form the backbone of the economy of any nation. They pay for roads, hospitals, education, defense, and a score of public welfare projects. In this blog, we explore taxes in India – the different types of taxes in India, their structure, and how India collects its taxes. Whether you are a salaried employee, a business owner, or an investor, this guide will help you know all about how India's tax system works.

Table Of Content

Why Understanding Taxes Matters

Types of Taxes in India

Direct Taxes: A Closer Look

Indirect Taxes - A Closer Look

How Taxes Are Collected in India

Implications for Individuals and Businesses

Investors and Property Owners

Conclusion

Frequently Asked Questions

Why Understanding Taxes Matters

Let’s start with the basics: what are the broad categories of taxes in India?

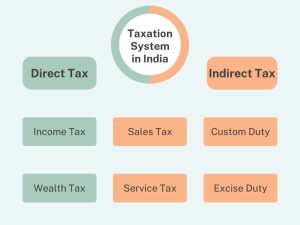

Types of Taxes in India

*SSCAdda

1. Direct Taxes

Direct taxes are levied directly against the income or profits of an individual or organization. These taxes cannot be transferred to another person. In simple terms, whoever earns the income is the one who pays the tax.

Some major examples of direct taxes include:

Income Tax:

Income earned by individuals, HUFs, and firms are taxed.

Corporate Tax:

This includes tax paid by the companies concerned on their profits.

Capital Gains Tax:

Paid on the gain made from an asset that includes shares and property upon sale.

Property Tax:

Collected on real estate ownership by municipal bodies.

Direct taxes have a big chunk in the basket of taxes and are very crucial for national revenue.

2. Indirect Taxes

Indirect taxes are the taxes levied on goods and services, not on the income of a person or an entity. These taxes can be passed on to others; for example, a seller adds the tax to the price and the consumer pays. Indirect taxes affect all people who purchase goods or avail themselves of services in India.

The major types of indirect taxes are:

Goods and Services Tax (GST):

A comprehensive tax on the supply of goods and services, replacing earlier taxes like VAT, service tax, and excise duty.

Customs Duty:

Tax on imported or exported goods.

Stamp duty and registration fee: Charged on property transactions. Put together, both direct and indirect taxes represent the entirety of taxes in India.

Direct Taxes: A Closer Look

1. Income Tax

Income tax is one of the most famous forms of taxes in India. It is levied on the income gained by individuals and businesses in a financial year. It is charged based on the slabs of income, which can be amended every year through the Union Budget.

All taxpayers in the country have to file an ITR every year, showing their income from salaries, house property, business or profession, capital gains, and any other source. A better understanding of how income taxes are collected in India will enable individuals to file their returns in time and avoid penalties.

2. Corporate Tax

Companies operating in India are liable to pay corporate tax on the profits made. The rates differ for domestic and foreign companies. Corporate tax is one of the major components of taxes in India, as it reflects the financial health of businesses and industries.

3. Capital Gains Tax

If you sell any asset, such as real estate, stocks, or mutual funds, for a profit, it is taxed. Capital gains tax is either short-term or long-term, depending on the length of time the asset was held before being sold. In India, it is one of the more specific tax types, and it directly affects investors.

4. Property Tax and Wealth Tax

Property tax is the amount levied by local civic bodies on the real estate held. Though wealth tax has been abolished, property tax remains an important local source of taxes in India, funding civic amenities and infrastructure.

*Tax Return Wala

Indirect Taxes - A Closer Look

Goods and Services Tax (GST)

GST brought uniformity to taxes in India by merging the many taxes into one. Though levied at each stage in the supply chain, it is borne by the ultimate consumer of the service or product. The GST structure consists of:

CGST: Central Goods and Services Tax

SGST: State Goods and Services Tax

IGST: Integrated Goods and Services Tax (for inter-state transactions)

GST made collecting taxes in India less complicated and allowed for better transparency and compliance.

Customs Duty

Customs duty is payable on goods brought within or taken outside India. It protects domestic industries and regulates international trade. This form of taxation illustrates how, in India, taxes are collected even at the entrance and exit points of trade.

Excise Duty and Other State Taxes

Before GST, excise duty was one of the major indirect taxes on manufacturing. Now, it applies only to a few products such as petroleum and tobacco. States also impose their taxes that include stamp duty, professional tax, and entertainment tax, adding diversity to the types of taxes in India.

How Taxes Are Collected in India

1. Legal Framework

Authority to levy and collect taxes in India emanates from the Constitution. It clearly divides the power between the Central and State Governments.

The Central Government deals with income tax, corporate tax, customs and central GST.

The State Governments collect the state GST, stamp duty, property tax, and excise on certain goods.

2. Modes of Tax Collection

Taxes are collected in the following ways in India:

Voluntary Payment: Individuals and companies compute and pay their taxes themselves by filing returns.

TDS: This is where a portion of the payment is deducted by the payer, who then deposits it with the government (such as an employer).

TCS: Some sellers are required to collect a percentage amount at source from buyers at the time of sale.

Advance Tax: The companies and professionals pay their estimated income tax in installments during the financial year. These methods ensure continuous and systematic collection of taxes in India throughout the year.

3. Tax Administration

The tax system is managed by:

Central Board of Direct Taxes: Oversees direct taxes.

CBIC-Central Board of Indirect Taxes and Customs: Responsible for the management of GST and customs.

GST Council: It coordinates between the central and state authorities on GST policies.

A streamlined administrative structure has helped in bringing about efficiency in tax collections in India and facilitated compliance for taxpayers.

Central, State, and Local Taxation Structure

The structure of taxes in India is three-tiered, with a central, state, and local level of governance.

Central Taxes: Income tax, corporate tax, customs, and central GST.

State Taxes: State GST, stamp duty, land revenue, professional tax and state excise.

Local Taxes: Property tax, water tax, and other municipal levies.

Understanding the bifurcation helps in recognizing how tax collection works in India and where the money finally goes – from the national exchequer to state and local development.

Implications for Individuals and Businesses

For Individuals

In India, the major types of taxes that most of its citizens pay are income tax, and above all, GST on goods and services purchased. Understanding the collection of taxes in India helps them keep track of their finances, plan deductions, and file returns correctly.

For Businesses

Businesses have to meet both direct and indirect tax liabilities. They have to get themselves registered under GST, collect and pay the same, and file returns periodically. They are also supposed to handle corporate tax and TDS compliances. Basically, awareness of taxes in India will help them be transparent and avoid penalties.

Investors and Property Owners

Conclusion

Understanding taxation in India is an important aspect for every citizen, be it an employee, business owner, or investor. Taxes are the financial backbone of the nation, driving growth, infrastructure, and welfare programs that benefit millions. By learning about the various types of taxes in India, such as direct and indirect taxes, individuals can make informed financial decisions, plan effectively, and remain compliant with their legal obligations. In addition, knowing how taxes are collected in India—through mechanisms that include TDS, GST, and voluntary payments—fosters transparency and accountability. Though seemingly complex, the recent digital reforms and simplifications have made compliance easier than it has ever been. In essence, paying taxes is not just a duty; rather, it’s your share in the development and prosperity of the country.

Frequently Asked Questions