Why Pursuing an MBA in FinTech is a Game-Changer for Your Career

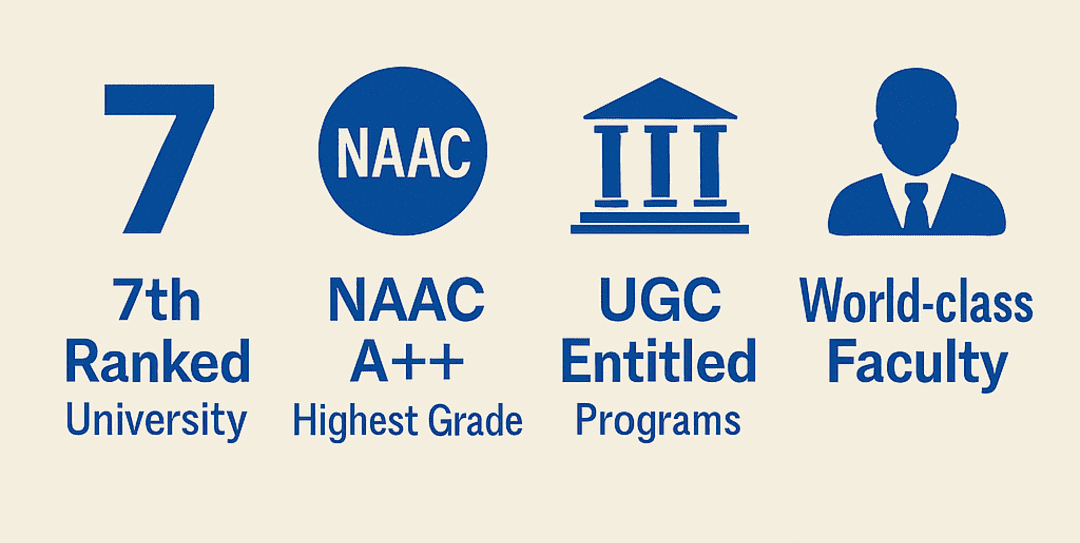

An MBA in FinTech gives you an understanding of finance, technology, and leadership. Students learn about artificial intelligence, blockchain, data analytics, and cybersecurity in terms of their roles in today’s financial management. Since the FinTech market is forecast to reach $500 billion by 2030, an MBA in the area helps students land jobs with good growth prospects and keeps them up-to-date in digital finance. Thanks to this degree, you will know what to do to reform banks, set up your own FinTech firm, or advise tech companies in the financial world. Among those institutions focusing on financial technology, Amrita Vishwa Vidyapeetham is considered a top destination for students.

In this all-encompassing guide, we cover what an MBA in FinTech is, its scope, the best FinTech MBA programs, FinTech career options, and all that is required for you to make a ‘go’ or ‘no-go’ decision. For recent graduates or working professionals, this guide explains how the MBA in FinTech is tailored for the future of finance.

Table Of Content

Why Amrita University for Your MBA in FinTech?

FinTech MBA Programs: What Makes Amrita’s Program Unique?

MBA in Financial Technology: Core Subjects and Skills

FinTech Career Opportunities After MBA

The Future of Business and Finance is in FinTech

Your Career, Our Mission: Expert Guidance for a Brighter Future

In the end, Is Earning an MBA in FinTech at Amrita Worthwhile?

Frequently Asked Questions

Why Amrita University for Your MBA in FinTech?

FinTech MBA Programs: What Makes Amrita’s Program Unique?

MBA in Financial Technology: Core Subjects and Skills

Amrita Financial Technology MBA in FinTech students are trained to solve problems and develop innovations in digital finance. Also, main learning areas and abilities should be considered carefully.

Core Subjects:

Financial Markets & Instruments

Corporate Finance

Principles of FinTech

Blockchain & Smart Contracts

Financial Regulations & Compliance

AI & Machine Learning for Business

Digital Payments & Mobile Banking

Cybersecurity in Financial Systems

Key Skills Gained:

Programming basics in Python and R

Financial modeling and data analysis

Understanding of blockchain architecture

UI/UX design in financial applications

Knowledge of regulatory compliance

The program teaches students to excel at technology and be skilled in management. Schools work on projects involving AI for fraud detection, create software for mobile banking, and build platforms for lending through blockchain.

FinTech Career Opportunities After MBA

The good job prospects that come with an MBA in FinTech are a key reason to choose this field. More financial institutions are looking to apply technology, so there is a greater need for tech-savvy finance experts.

Top FinTech Career Opportunities | Role | Salary |

Product Manager – FinTech | Develops and manages digital financial products. | ₹15–30 LPA |

Blockchain Analyst | Designs secure and scalable decentralized financial systems. | ₹10–25 LPA |

Financial Data Scientist | Uses AI/ML to analyze trends, predict risks, and optimize portfolios. | ₹18–35 LPA |

Digital Banking Specialist | Oversees the development and implementation of online banking platforms. | ₹12–28 LPA |

Compliance & RegTech Officer | Implements tech-based solutions for regulatory compliance. | ₹10–22 LPA |

Source: Glassdoor

The Amrita MBA in FinTech offers a huge number of employment opportunities after graduation. You will find satisfying jobs in tech, banking, or regulations if that’s your area of interest.

People who have graduated from Amrita have already started their careers at well-known firms such as Paytm, Razorpay, Axis Bank, Infosys Finacle, a nd Amazon Pay.

The Future of Business and Finance is in FinTech

FinTech is not only here now—it will change the way we deal with finances forever. In India, people are used to UPI transactions, and in Europe, digital payments rely on blockchain technology. This degree helps you become part of the major changes going on in the financial sector.

The FinTech sector in India is likely to grow to $1.3 trillion by 2025 and already contains more than 10,000 FinTech companies. Startup India, Digital India, and government schemes about financial inclusion have added to the rise of FinTech in India.

Your Career, Our Mission: Expert Guidance for a Brighter Future

Jaro Education does everything with a strong focus on your achievements. Because more than 90% of our student placements and career transitions are successful, our expertise has helped countless people accomplish their career aspirations. We offer you help with personal support, self-improvement, college admission, and getting ready for a career, all relating to your goals. With their industry and academic knowledge, our mentors make sure you are learning in advance of the industry’s needs. We have your career in mind, so we’re ready to walk with you all the way to achieve more in your future.

In the end, Is Earning an MBA in FinTech at Amrita Worthwhile?

Absolutely. There is great demand today for the MBA in FinTech as a postgraduate option. Now that so much is online, investment in FinTech is growing, and there are more job openings worldwide, today is an excellent time for it.

Amrita University’s MBA in FinTech is one of the top and most focused programs in the country. Because it features great infrastructure, expert instructors, and excellent job placement, this is the right spot to begin your career in FinTech.

Therefore, if your goal is to start a career at the intersection between finance and technology, you can find what you’re looking for in Amrita University’s MBA in FinTech.

Frequently Asked Questions