The Best Financial Management Course for You in 2025

Table of Contents

The finance landscape is changing rapidly like never before. Technological changes are transforming various industries and global marketplaces; therefore, understanding financial management has never been more important.

If you’re a student considering a career, a professional wanting to add skills to your portfolio, or an entrepreneur trying to train and create a financially viable business, financial management has several options for engaging career advancement. Overall, financial management is designed to provide individuals with valuable skills on how to effectively manage money when it is available while also preparing people to use critical thinking to make optional information-based decisions that can ultimately lead to success for themselves and their organizations.

In this blog, we will dive into why financial management is important, the different career paths available, and the top financial management courses you’ll be able to take in 2025. We will also discuss the scope of financial management to understand how you can pursue a successful career ahead. Let’s get started.

*sophiacollege.ac.in

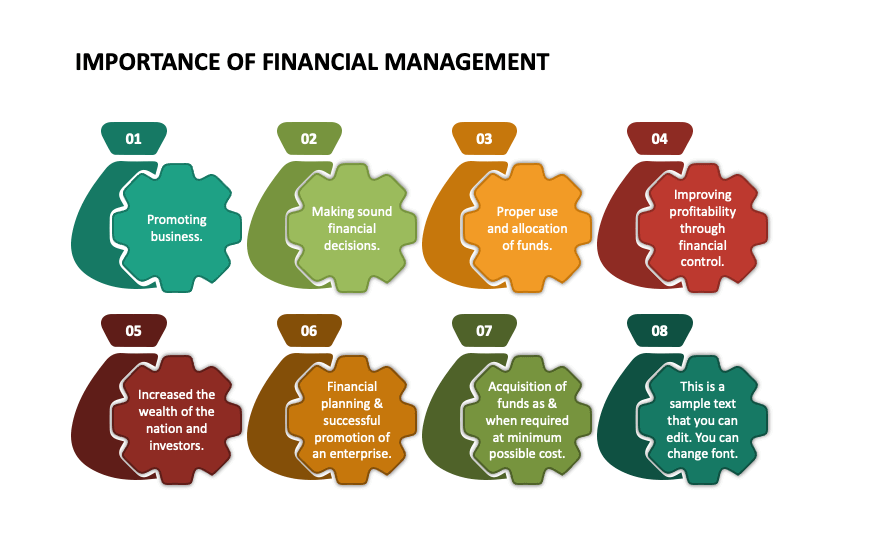

Why financial management is Important

Financial management is a main component for an organization’s or individual’s financial well-being. It includes the planning, organizing, directing, and controlling of the financial activities that are necessary for sound decision-making and achieving specific goals. The principles of financial management courses are increasingly fundamental due to the complexities of today’s economics, and understanding them is essential.

The given reasons below show why learning financial management is essential:

1. Informed Decision-Making

Effective financial management courses enable individuals and organizations to make informed decisions about a multitude of options for investment, budget disposition, and use of resources. An important part of this involves being able to interpret and analyze financial statements and forecast future financial trends to make educated judgments about the financial health of an organization. For example, an organization looking into investing in a new project must look at various cost benefits and returns.

The professional can use an array of solid financial analysis and reporting procedures to interpret and analyze financial statements, determining if the project meets long-term strategic goals. Likewise, individuals or entrepreneurs managing their finances need to understand their income, expenses, and various types of investment vehicles to fully make informed decisions.

2. Risk Management

Effective risk management courses are essential to ensuring the survival of individuals and organizations in today’s unpredictable economy. Through managing finance, both individuals and organizations can learn how to recognize, quantify, and manage financial risks.

Understanding exposure to risks—whether from changes in a market or regulation changes—enables organizations to develop risk management strategies to limit negative outcomes. Organizations can generally face three types of risk: credit risk, market risk, and operational risk. As finance professionals use risk management strategies, such as diversification and hedging, to create buffers, both individuals and organizations can build a foundation of wealth and stability.

For individuals, understanding risk is essential; financial management can allow for the creation of a portfolio of investments that takes advantage of opportunities while still recognizing their risk tolerance and goals for their money.

3. Resource Optimization

There are many reasons why it is important to manage the finances of an organization in a way that regards the three components of financial management as the best use of responsible resources.

For example, an organization may decide to invest in a new product, a new product line, a new product component, or a new market venture. Any of these decisions would need extensive financial management analysis to tie back to the potential return on investment, as each one includes financial risk. Individuals also need to optimize their financial means to reach personal objectives, such as buying a new car, buying a new home, saving for children’s education, and saving for retirement.

Financial decisions, budgets, and the means to reach these objectives can lead to improved financial health and, most importantly, the intended personal goals of these individuals. Overall, financial management encompasses budgeting, cost and cash flow analysis, and fiscal policy facilitation, among other areas discussed throughout the book. Each of these areas needs to be developed to hopefully make eventual positive financial outcomes.

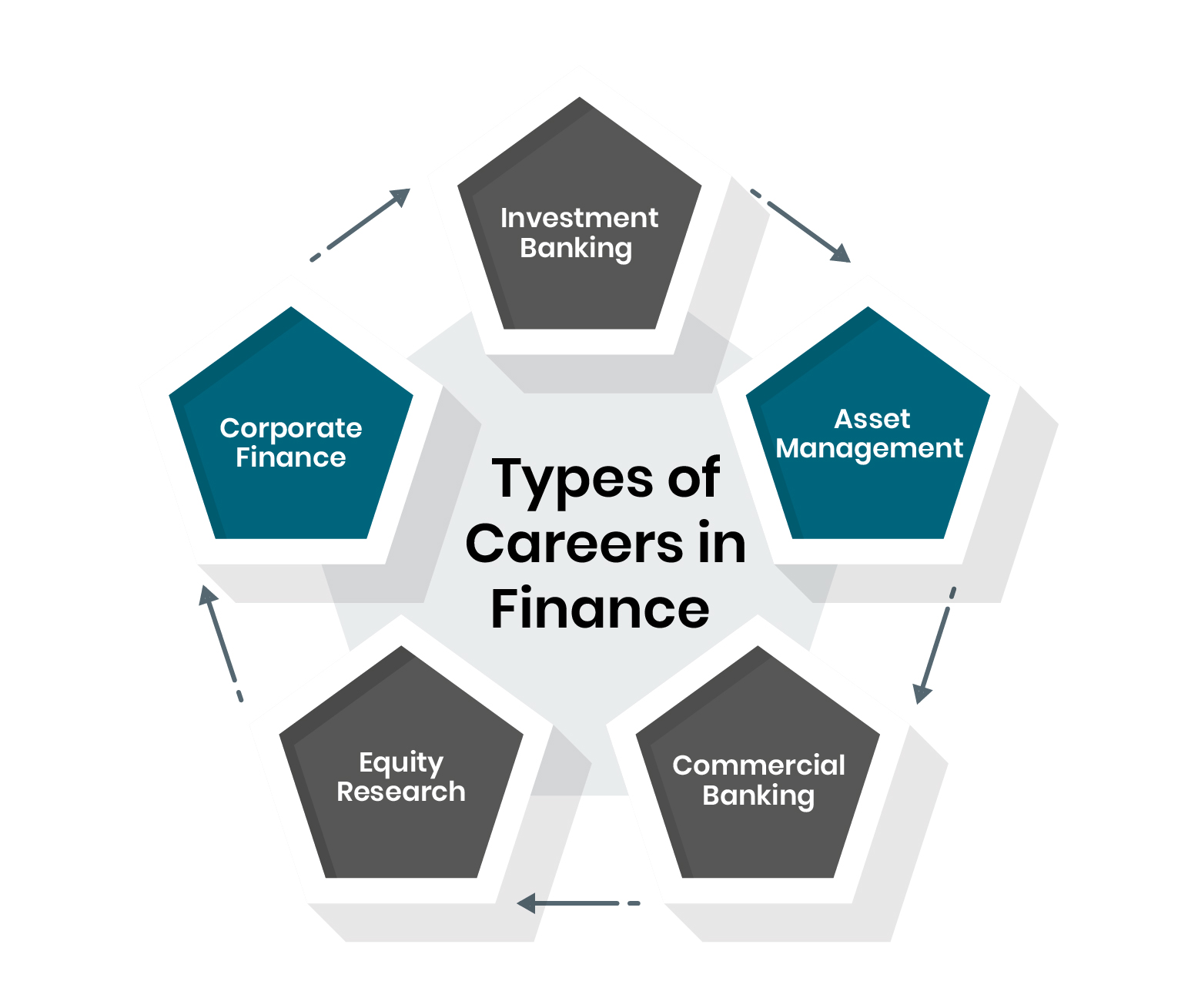

4. Career Opportunities

The demand for finance professionals has increased in both a growing financial marketplace and an increasingly complex financial environment. Finance managers are needed across various industries of work… banking, investment, corporate finance, etc.

A good understanding of financial management provides many employment options. There is a high demand for analysts, investment bankers, and risk managers, all having excellent potential salaries and the possibility of career advancement.

Additionally, as businesses depend more on financial technology and data analysis, there is an increased demand for professionals with roles and experience in this area. Careers in finance offer job security as well as the opportunity to help shape and organize success.

5. Personal Financial Success

On a personal level, financial management is essential for budgeting, saving, and investing wisely. Understanding how to manage your finances can lead to better financial security, allowing you to achieve personal goals such as homeownership, travel, or retirement.

Individuals who practice effective financial management tend to have a clearer understanding of their financial situation. This includes tracking expenses, setting savings goals, and making informed investment decisions. By employing budgeting techniques and financial planning tools, individuals can create a roadmap to achieve their financial aspirations. Furthermore, being financially literate empowers individuals to make proactive decisions about their money, leading to long-term financial health and stability.

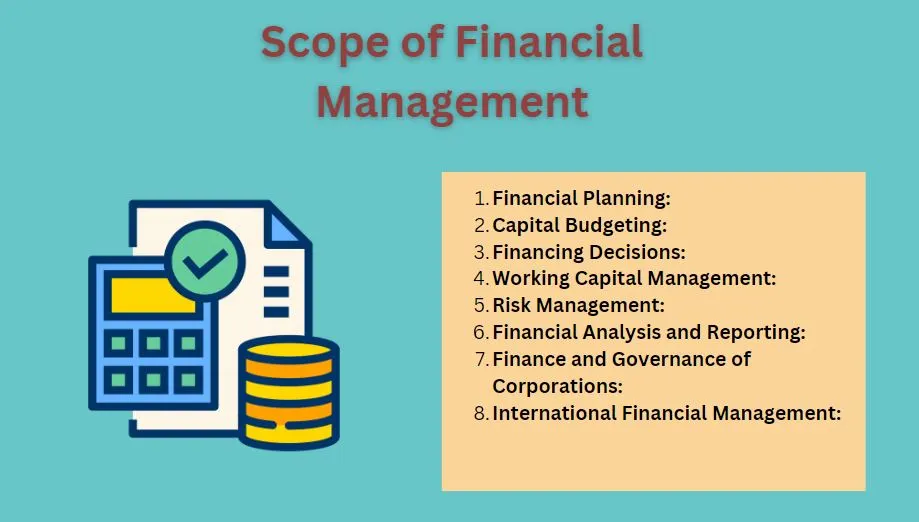

Scope of financial management

The financial management sector is extensive and growing all the time, with a range of opportunities offered in various industries. Basically, financial management means planning, organizing, directing, and controlling financial activities with the objective of achieving an organization’s objectives. Furthermore, the financial management field comprises personal finance, corporate finance, investment analysis, and financial consulting.

*managementnote.com

Personal Finance

Personal finance is concerned with how a person is doing financially, which means budgeting, saving, investing, and retirement planning. As financial literacy becomes more widely accepted, there is an increased need for professionals to help individuals make informed decisions about their money. This group includes financial planners and advisors who assist clients with personal financial matters.

Corporate Finance

Corporate finance revolves around the management of a company’s financial resources to enhance shareholder value. This encompasses decisions relating to capital investments, funding strategies, and the oversight of financial risks. Corporate finance professionals perform such tasks as analyzing financial statements, assessing potential capital investments, and developing long-term financial strategies. As businesses develop, corporate finance positions will become critical to successful operations as they manage complex financial structures and help businesses achieve sustainable financial growth.

Investment Analysis

Investment analysis involves evaluating investment opportunities and managing asset portfolios. This area has gained prominence as more individuals and institutions seek to grow their wealth through investments. Analysts and portfolio managers are tasked with assessing market trends, analyzing financial data, and making strategic investment decisions. The rise of data analytics tools enhances the ability of finance professionals to make informed predictions and investment choices.

Financial Consulting

Financial consulting provides organizations with expert advice on financial management, risk assessment, and strategic planning. Consultants analyze a company’s financial health and recommend strategies for improvement. This area is thriving as businesses seek specialized knowledge to navigate challenges and optimize performance.

The Impact of Technology

The rise of technology in financial management, especially data analytics and fintech, is transforming the sector. There is a demand for professionals who can utilize these innovative technologies in their roles. Fintech startups are developing at rapid rates, creating fresh roles that merge finance with technology, such as data analyst, risk modeler, or blockchain technology.

This intersection enables efficiency and exposes opportunities for new ideas in the finance services industry. To summarize, financial management is a wide scope of topics that are important for individuals and organizations alike. As the field continues to change, finance professionals equipped with current skills and knowledge will experience a high financial management salary and a wealth of opportunities to be successful within the industry.

*investmentbankingcouncil.org

Pursuing a Career in financial management

If you’re considering a career in financial management, several educational pathways can help you achieve your goals. Here are some top financial management courses to consider:

1. Online MBA—Manipal University, Jaipur

Manipal University offers an Online MBA program that allows students to specialize in financial management. This program is designed to provide a solid foundation in both theoretical concepts and practical applications.

Key Features:

- Flexible Learning: The online format allows students to balance their studies with work or other commitments.

- Industry-Relevant Curriculum: Courses cover essential topics such as financial analysis, investment strategies, and risk management.

- Networking Opportunities: Students can connect with professionals and alumni, enhancing their career prospects.

By choosing this program, you can gain the necessary skills to excel in various finance roles, from financial analyst to corporate finance manager.

2. Online MBA – Dr. D. Y. Patil Vidyapeeth

Dr. D. Y. Patil Vidyapeeth offers an Online MBA program that focuses on developing strategic thinking and leadership skills in finance. This program is ideal for those looking to enhance their managerial capabilities while deepening their understanding of finance.

Key Features:

- Comprehensive Curriculum: The program includes courses on corporate finance, financial markets, and strategic management.

- Expert Faculty: Learn from experienced faculty members who bring real-world insights into the classroom.

- Global Recognition: The degree is recognized globally, opening doors to international career opportunities.

This program prepares students for leadership positions, equipping them with the tools needed to make strategic financial decisions.

3. Online MBA Degree Programme – Symbiosis School for Online and Digital Learning (SSODL)

Symbiosis School for Online and Digital Learning offers an innovative Online MBA program with a specialization in financial management. This course is designed for professionals who want to enhance their financial acumen while developing managerial skills.

Key Features:

- Interactive Learning: The program utilizes cutting-edge technology to facilitate interactive learning experiences.

- Diverse Electives: Students can choose from various electives, allowing them to tailor their education to their career goals.

- Focus on Digital Finance: With the increasing importance of technology in finance, this program incorporates digital finance topics, preparing students for the future of the industry.

Graduates of this program will be well-equipped to navigate the challenges of modern finance, making them valuable assets to any organization.

How Can Jaro Education Help You Build a Successful Career in Financial Management

Jaro Education is India’s leading online higher education provider, renowned for its trustworthiness. For the past 15 years, the company has significantly influenced the careers of professionals through dedicated career counseling and academic support. Jaro Education is dedicated to empowering entrepreneurs and working professionals at every stage of their careers, from entry-level positions to C-suite executives, by offering customized executive education programs tailored to their specific needs.

In collaboration with prestigious institutions, Jaro Education offers a diverse array of over 150 programs in management, technology, and techno-functional areas. Enrolling with us means you get access to exclusive opportunities, all tailored to your success. Here’s how we help you thrive in your financial management journey:

- Unparalleled career guidance and support

- Dedicated student support

- Immersive and lifelong learning experiences

- Be a part of discussions and forums for enhanced learning

- Leverage peer-to-peer learning experience

Conclusion

As 2025 continues, financial management is growing exponentially in importance. The scope of study extends beyond just a few areas or industries; personal finance, corporate finance, investment analysis, and finance consulting are just a few areas for potential educators willing to invest time into their education.

Frequently Asked Questions

What are the prerequisites to get into an online degree program for MBA financial management?

Typically, most programs require you to have a bachelor’s degree from an accredited college or university. Some programs may value any work experience related to finance.

How long will it take to complete one of those online degrees to get an MBA in financial management?

In general, you can expect an online MBA program to take between 1 and 2 years to complete, depending on the program, if you are studying full-time or part-time, and so on.

Will employers value online degrees to get an MBA in financial management?

Yes, many employers will favor degrees from recognized online MBA programs, especially if the institution is well known and respected in the industry.

What kinds of jobs can I find after I get my degree in MBA financial management?

One can find a major job with a financial management MBA, but some examples are financial analyst, investment banker, corporate finance manager, financial consultant, risk manager, and more.