Top Investment Banking Courses Online in 2025

Table of Contents

In the year 2025, the financial world continues to experience fluctuations, with investment banking emerging as a key sector offering significant career opportunities and new trends. This ever-evolving investment banking industry revolves around managing large-scale investments, mergers, and acquisitions, corporate financing, etc. In essence, professionals like investment bankers or corporate investors channel the complexities of the financial markets. To build a successful career in this dynamic field, pursuing the best investment banking course will be a game-changer as they have several interdisciplinary and lucrative topics.

If you are considering a career in investment banking, an excellent first step would be to sign up for one of the online courses. The flexibility and in-depth approach of online learning would enable you to acquire the skills at your rhythm and pace.

This blog will focus on the best investment banking courses offered online in 2025 along with their fee structures, placements, and their relevance toward working professionals considering India.

Why Choose Investment Banking Courses?

*Statista

But before we get into IIM Kozhikode courses, we should look at why investment banking remains the first choice for finance professionals.

- Very Big Pay: Be it an investment bank, be it a financial analyst job, or even a corporate finance management job, investment banking pays probably the highest in the finance circle. This reason makes investment banking such an interesting career concept.

- Fast-Paced Environment: Investment banking is very fast-changing, which gives great vitality and excitement to the field of work. Investment bankers would find themselves ever busy working on high-stake transactions with big mergers, acquisitions, or strategic sale transactions of great complexity.

- Skill Enhancement: This industry offers good opportunities that fine-tune one’s skills in the area of financial analysis, analyzing risks, investing strategies, or communicating with clients. To some degree, such skills are transferable giving a growth factor into other areas within finance.

With this background of some attractions of investment banking, we now look into some of the best investment banking courses online that IIM Kozhikode offers and their effect in working toward your aspiration.

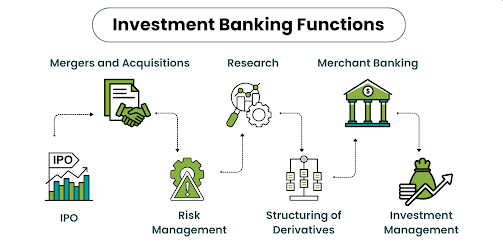

Investment Banking Function

*WallStreetMojo

1. IPO

An initial public offering (IPO) is an investment banking function whereby a company appoints an investment bank for the issuance of the IPO.

IPO-one of the major investment-banking functions. The investment bank helps set everything up for a firm to list an IPO on the stock exchange. The bank, however, charges a commission for its work.

2. Mergers And Acquisitions

The corporate finance and management disciplines, deal with the acquisition of or joining a company. Quite in return, an M&A investment bank is paid a fee. The M&A company hires a bank for mergers and acquisitions, and the banks will then take various steps in the entire M&A process.

3. Management of Risks

The title of Risk Management makes it obvious that all risk management is a continual process involving capital. It sets a limit to avoid losses in business. Investment banks undertake the following functions for the management of risk:

Investment banks allow companies to manage their financial risk to currency, loans, liquidity, etc.

This bank helps the company to identify loss areas.

4. Research

This equity research investment banking function is one of the most important investment banking functions. This research helps provide a rating to the company to help investors determine investment. Research reports tell whether to buy, sell or hold based on a company’s rating. Through this, one can know the worthiness of the company. Research is done by analyzing and comparing various types of company reports, performance reports, etc.

The primary work done by investment banks is research, and very different types of research are done, like equity research, fixed-income research, macroeconomic research, qualitative research, etc. Investment banks share these reports with clients, enabling the investor to generate profits through trades and sales.

5. Structuring of Derivatives

Investment banks produce highly profitable derivatives plagued with heavy risks, single or multiple sets of securities based on the specific structure in question.

For this Investment banking function, which deals with structuring derivatives, investment banks require a strong technical team that can deal with such a complex structure of derivatives.

Investment banks design securities with different derivative opportunities. The main reason that a product is designed is to attract investors and increase profitability.

6. Merchant Banking

This investment banking function is one of the personal activities of the investment bank when it acts as a consultant for its clients. It works as a financial engineer for companies. It offers advice on financial, marketing, legal, and managerial matters.

Merchant banking has the following functions:-

- Raising finances for the client

- Broker in Stock exchange

- Project management

- Money market operations

- Leasing service

- Portfolio management

- Handling government consent for industrial projects

- Managing public issues of a company

- Special assistance to small companies and entrepreneurs

7. Investment Management

This investment banking function is concerned with assisting the investor in purchasing, managing his portfolio, and trading various securities. The investment banks prepare reports related to the performance of the company based on which the investment bank decides on financing the securities. Here, the investment bank will manage a portfolio of customers and advise them on whether to sell stocks, buy stocks, or hold stocks.

Top Investment Banking Courses Online in 2025

The most excellent online courses in investment banking come with so much flexibility that you may work at your own pace. Next, we will take a look at the best investment banking courses to be in demand by 2025 and how IIM relates to the picture.

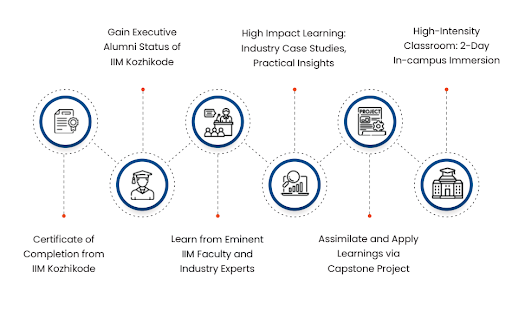

Investment Banking Courses at IIM Kozhikode: An Overview

Ready to go into the high-stakes world of financial transactions, mergers, acquisitions, and capital markets? If you are planning to embark on a career in investment banking, the kick-off for your investment banking journey can be none other than the Professional Certificate Programme in Investment Banking – IIM Kozhikode.

The programme is carefully crafted to empower participants with advanced skills in corporate finance. Topics of advanced mathematics, applied economics, corporate valuation, mergers and acquisitions, and corporate restructuring. The intention here in placing these concepts in the context of the Indian investment banking environment was to provide a holistic understanding of the unique challenges and opportunities in the sector.

Participants are enabled to gain insight into the strategic and analytical side of investment banking with which value is created in financial advisory, capital raising, and corporate transactions. The certification augments not only the technical expertise of the participants but also their strategic thinking skills, thereby putting them in a position to excel in the ever-changing environment of investment banking.

Key Highlights of IIM Kozhikode’s Investment Banking Courses

- Throughout your course, you will use case studies to look at real-life transactions like M&As, IPOs, and LBOs.

- Interactive Learning: Online courses, seminars, and discussions with industry players.

- Comprehensive Curriculum: The programme focuses on corporate finance, financial modeling, valuation techniques, M&A structuring, and more.

- Global Credibility: IIM Kozhikode, recognized as one of India’s top IIMs, carries immense global credibility and recognition. This enhances the participant’s credibility across the dynamic industry.

Investment Banking Course Detail at IIM Kozhikode

To afford the skills, knowledge, and insight to survive in such a highly competitive industry, the best Investment Banking Course online offered at IIM Kozhikode will furnish an opportunity. Whether it is an entry-level position in investment banking, preparation for subsequent work in other finance areas, or the mere mechanics of financial markets that interest you, this course will let you deal with all.

The course described in detail below would thus deliberately set in place for you to empower yourself adequately for the successful tackling of the challenges faced within the investment banking world.

So, are you ready for elevation in your career?

Here you will discover all about the IIM Kozhikode the best Investment Banking course!

| Duration | 10 Months* | 120 Hours of Learning |

|---|---|

| Mode of Delivery | Direct-to-Device (D2D) mode |

| Campus visit | One Visit for 2 days. |

| Programme Schedule | Sunday, 3:30 pm to 6:30 pm |

Eligibility Criteria:

- The programme is open to graduates with a three-year degree or above, or diploma holders with a two- or three-year degree, from any recognized university (UGC/AICTE/DEC/AIU/State Government/recognized international universities) in any discipline, as by the time of consideration.

- The candidate must have full-time work experience of at least 1+ years after graduation towards the Technical Orientation date of the programme.

- The selection will be based on an elaborate profile of the candidate in their own words on Academic record, Profile, Designation, Salary, Roles, Responsibilities, Job Description, and write-up on “Expectations from the Programme.”

Investment Banking Course Fees at IIM Kozhikode

This interdisciplinary investment banking course at IIM Kozhikode positions you to carve a niche in one of finance’s most dynamic and lucrative fields. Designed for ambitious professionals, the programme combines globally renowned faculty, an industry-aligned curriculum, and powerful corporate networks to deliver unparalleled ROI—both in career growth and financial advancement.

Fee Structure

- Application Fee: INR 2,000/- + GST

- Total Programme Fee (exclusive of application fee): INR 2,40,000/- + GST

Best Investment Banking Course in India: Why IIM Kozhikode Stands Out

The IIM Kozhikode course for investment banking finds its uniqueness for many reasons across all spectrums of online courses in investment banking:

1. World-Class Education

IIM Kozhikode is known internationally for its innovation in pedagogy and research and its strong industry partnership. The best Investment Banking course online from IIM Kozhikode provides high-quality education; indeed, some of the eminent financial institutions of the world recognize it.

2. Comprehensive Curriculum with Certification

The IIM Kozhikode investment banking programme intends to explain the entire panoramic view of the investment banking industry. Financial modeling, M&A deals, capital markets: all of these subjects are touched upon to build the foundation of students for various job assignments in investment banking. Participants who successfully complete this course will receive a certificate of completion from IIMK that will add another feather to their credentials.

3. Networking Opportunities

When participants’ enters IIM Kozhikode, they gets the chance to connect to an extensive alumni network that comprises finance professionals. Networking is crucial for maintaining connections in the investment banking domain, and IIM Kozhikode provides the right opportunities to network with other professionals in the industry.

ROI Calculator

Jaro Education’s Return on Investment (ROI) calculator allows students to approximate their return from various educational programmes. While individual calculators may differ in each domain, we will generally explain how an education-oriented ROI calculator would work for an institution such as Jaro.

Here is how to calculate ROI using Jaro Education’s ROI calculator:

- First Enter Your Programme Fees: Fill in the total fees of the programme you are targeting, whether Investment Banking, MBA, or other courses.

- Estimation of Expected Salary after Completion: Fill in your current salary and the expected salary increment after completing the programme. You would factor in possible career advancement, promotions, or new job opportunities accompanying your degree or certification in this case.

- Accrual Period for Post-Graduation Salary Increment: Fill in the number of years you expect to start benefitting from the qualification in terms of a salary increment. Usually, this is about 1-3 years post your graduation.

- Break-even Calculation: The calculator will next tell you how long it would take before you can recover the investment you made in the course given your salary increment, which can tell you mostly when you can start seeing any returns.

- Return on Investment: Percentage View: ROI, the calculator, shows the returns in percentage for the applicability of the returns from the course, thereby clearly understanding if the programme will bring substantial financial benefits long-term.

Conclusion: Your Path to Success in Investment Banking with IIM Kozhikode

The IIM Kozhikode Investment Banking Programme can be seen as truly comprehensive in its global career opportunity in finance since it offers both theoretical inputs as well as practical and industry-oriented experience.

And now it’s your turn! Whether a complete switch or just an enhancement of an existing one, this programme promises to unleash your full potential in the direction of your dream career.

Are you ready to lay the foundation for your future in investment banking? Well, let’s go; your success story kicks off here!

Frequently Asked Questions

The best investment banking course online is a specialized programme that teaches the skills and knowledge needed for a career in investment banking. This includes understanding financial markets, mergers & acquisitions (M&A), capital raising, financial modeling, valuation, and more.

Eligibility criteria can vary by institution. However, for most programmes like IIM Kozhikode’s, applicants typically need:

- A Bachelor’s degree (preferably in business, finance, or related fields)

- A strong interest in finance and banking

- Some programmes may require work experience in finance, but this is not always mandatory.

The best Investment banking courses online generally cover topics such as:

- Financial Analysis & Accounting

- Corporate Finance

- Mergers & Acquisitions (M&A)

- Financial Modeling and Valuation

- Capital Markets

- Equity and Debt Financing

- Risk Management

- Derivatives and Hedge Fund Strategies

The duration of investment banking courses online varies. At IIM Kozhikode, for example, some programmes may last a few months, while more advanced or comprehensive programmes might span a year. Online options may offer flexibility in terms of duration, allowing you to learn at your own pace.