How Strategic Management Drives Business Growth And Sustainability

Table of Contents

Strategic management includes recognizing and deploying a company’s resources satisfactorily to attain its business objectives. It may also be considered as one developable skill and a core focus of any graduate business curriculum.

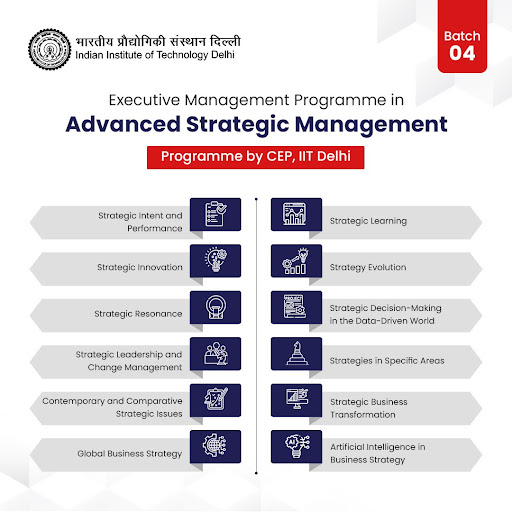

This article will explain the advantages of strategic management, benefits of strategic management, objectives and goals of strategic management, and types of strategic management. Afterwards, should you wish to bolster the importance of strategic management skills, think about joining the Executive Management Programme in Advanced Strategic Management – CEP, IIT Delhi, where you will learn about the major tools of analysis to assess key business situations.

The Importance of Strategic Management

*TestGorilla

- Provide Direction and Support

The making or breaking of a company. Therefore, the importance of strategic management becomes necessary. Articulated strategies provide better direction for business. These strategies make critical decisions, such as:

- Where do we want to go?

- On what should we concentrate?

- How can we get there?

With a good strategy, every action within the company is tied to the larger purpose of the business. The focus keeps the company grounded; less distraction would otherwise move its goal away from the main aim.

Interactive Question for You: I want you to think of a situation where a business seemed to lack direction. Evaluate how that affected its growth or decision-making.

- Decision-Making

Another defining benefit of strategic management is that it enhances decision-making. If clear strategies are laid out for the business, decisions are easier to make. Managers and leaders do not need to rely on hunches and feelings; they can analyze options based on how well they fit into the objectives of the company.

For instance, if the strategy is focused on innovation, then investments in new technologies and products will be prioritized. If cost leadership is the strategy, decisions will be focused on reducing costs and becoming more efficient.

Quick Introspection: Do you think businesses with a defined strategy make better decisions?

- Assists in Appropriate Resource Allocation

In any organization, resources such as time, capital, or human effort are limited. The importance of strategic management ensures that these resources are properly allocated, focusing on those areas that will yield the greatest returns. It allows a firm to efficiently spend its energies on the right projects, making the best use of the resources available without wasting time and money.

- Augments Premium Competitive Advantage

Importance of Strategic management identifies opportunities that can provide the firm with unique value contrasting to the competitors. These could either refer to innovations, customer service, brand reputation, etc. With an appropriate strategy, the company can achieve an advantage over its competitors.

Interactive Thought: Can you think of an organization that has a different identity from its competitors? What do you believe will set them apart from others concerning the strategy?

- Long-Term Success

We need to enjoy short-term success, but a business is said to be successful if it is a long-term success. The importance of strategic management helps an organization focus on keeping a balance between winning short-term opportunities and pursuing long-term growth. By continuously assessing and modifying its strategy to suit changing circumstances, a business will survive against market transitions and economic tremors.

Case Studies in Strategic Management: Real-Life Examples of Success and Failure

The importance of strategic management is very important for the success of any organization and is a process of selecting and implementing strategies to achieve long-standing goals and objectives. By studying real-life examples to tell the importance of strategic management in action, we can better appreciate the power and effect of importance of strategic management planning.

*Investopedia

Apple Field-Controlled by Steve Jobs-Management Examples show the strategy in action. Jobs returned to Apple in 1997 when the company was just about to go bankrupt. Apple under Jobs’ return from 1997 was very near collapse. Jobs soon returned with his very strategic direction emphasizing innovation, design, and customer experience. This advantage of strategic management injection led to the creation of epoch-defining products, from the iPod to the iPhone to the iPad, and from being one of the most valuable companies in the world.

*Variety

This is an example of a transformation where Netflix shifted from a DVD rental service to a global streaming service. In other words, it recognized that online streaming was catching consumers’ interests and decided to pour considerable investments into developing its streaming service. The decision provided them with the importance of strategic management initiative to not only gain precedence in the streaming industry but also dethrone conventional television networks, hence granting great market growth and profit for the company.

From the above examples, we can see that strategy in action has generated successful importance of strategic management results. Organizations can achieve their long-term goals, given proper respect and importance for strategic planning and implementation, to ensure company competitiveness in the dynamic business environment of today. The importance of strategic management forms a pillar upon which rests the success of the organization, and the events of the growth and transformation of companies like Apple and Netflix also exemplify such.

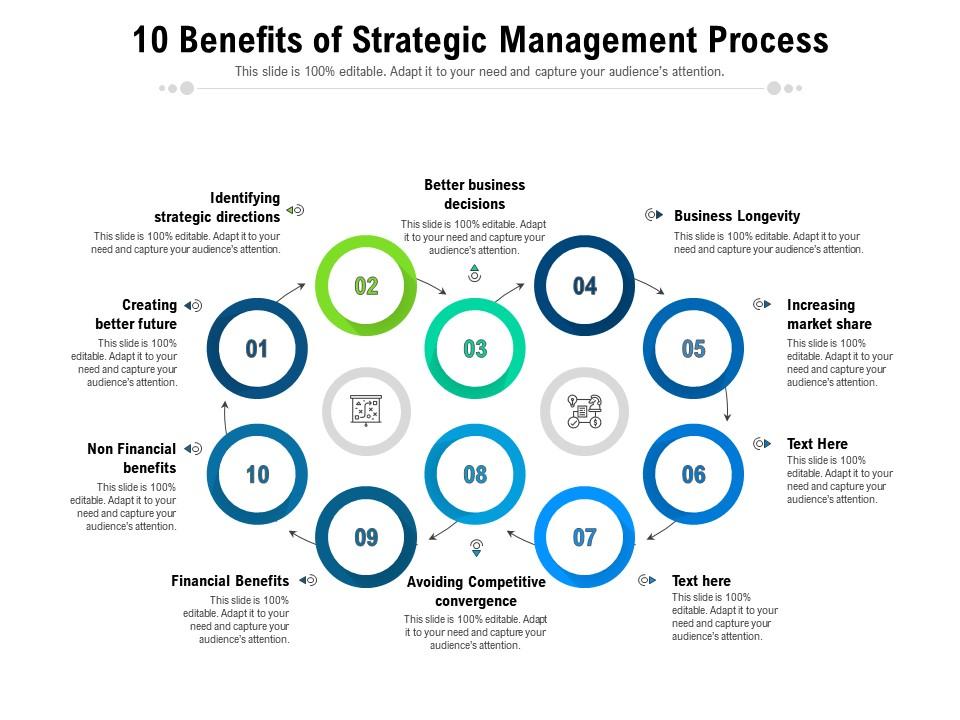

Benefits of Strategic Management

*SlideTeam

Objectives and Goals of Strategic Management

Importance of strategic management concerns itself with the following objectives and goals of strategic management:

- Direction Setting: The setting in place of a clear path for the organization through the exposition of its vision, mission, and long-range objectives. This helps align the efforts of the organization toward a common purpose.

- Achievement of Competitive Advantage: This is in respect of initiatives to contemplate and convert into actual strategies that depart from the idea of the organization gaining competitive advantage. One way the strengths could contribute to the opportunity is to avert threats to performance, in which case the situation could allow the organization’s performance to better gain against its rival.

- The Allocation of Resources: The effective management of all kinds of resources economic, human, or technical. Allocation under objectives and goals of strategic management policies takes precedence to attain desired results while working around the resources available.

- Adaptation: This enables an organization to modify itself under the rhythm of the changing environment by scanning external factors, predicting imminent changes, and conceptualizing proactive measures. This will allow for the benefits of strategic management in market dynamics and trend adaptations.

- Enhancing Performance: The core objectives and goals of strategic management are concerned with improving the performance of the organization in general. It has to do with the financial interest of growth in market share and operational efficiency as well as another interest which is to add value for the shareholders.

- Long-Term Viability: This means the sustainability and viability of the organization through and beyond the long term. This is made possible by the acceptance that social, environmental, and ethical considerations must take precedence for responsible and sustainable business practices to have dominance.

Types of Strategic Management

An approach to the importance of strategic management is one of the most crucial processes enabling the hearts of organizations to define their pathway by making decisions consonant with their goals. Many approaches are integrative of the global objective of a firm with its environment and resources. Herein, we shall illustrate the various types of strategic management that are being practised by businesses to make themselves successful, performance-oriented, and competitive.

1. Corporate Strategy

What is Corporate Strategy?

Corporate strategy is the highest level of strategy within the firm, concentrating on determining the overall direction of the business. This concerns decisions on the extent of the organization- new markets, diversifying products, mergers, acquisitions, and partnerships.

Distinctive Features:

- Focuses on the total goals and resources of the organization.

- Defines the business scope (markets and industries) of the organization.

- Involves top-level decision-making in matters such as mergers, acquisitions or diversification.

Example:

Apple is involved in corporate strategy to spread its wings into areas like wearables, cloud computing, and services over and above its hardware business itself.

2. Business Strategy

What is Business Strategy?

Business Strategy relates to how a company competes in a specific industry or market. Such strategies can assist companies in gaining a competitive advantage and describing how they will compete in their respective target markets. Business strategy revolves around gaining an advantage from product differentiation or cost-cutting so that customers can purchase at lower prices.

Distinctive Features:

- Competitive scope: To outperform competitors in the industry.

- Pertains to a particular product or service provided by the company.

- Sets up the pricing strategy, target market, and customer.

Example:

*Reuters

An example is Nike, which pursues a business strategy of differentiation through the supply of high-quality and innovative athletic gear, strongly focused on brand image and customer loyalty.

3. Functional Strategy

A functional strategy is an action plan or strategy adopted by a specific department or function within an organization-again, like marketing, operations, finance, human resources, or research and development. Each of the functions sets down its own strategy in line with the company’s overall goals to ensure the smooth and efficient running of day-to-day operations.

Distinctive Features:

- The focus is on specialized departments (e.g., marketing, finance, HR, etc.).

- Each functional strategy is made to aid the business strategy.

- Optimization of internal resources for improving efficiency and effectiveness.

Example:

Marketing might create a functional strategy to promote the brand using campaigns through social media, sponsorships, and influencer marketing, with the overall business strategy kept in mind.

4. Innovation Strategy

What is an Innovation Strategy?

An innovation strategy is the type of strategic management creating and introducing products and services and/or business processes to add value to customers. This strategy will centre on trendsetting by providing funds for R&D while also cultivating elements sustaining an innovative culture for growth.

Distinctive Features:

- Focus on product or service innovations.

- Encouragement of R&D and creative problem-solving.

- Goals include market disruption with fresh offerings that hit the spot for customer needs.

Example:

*Free Logo Design

The innovation strategy in Tesla is designing ground-breaking electric vehicles and sustainable energy products, thereby establishing itself as a leader in green technologies and clean energy solutions.

5. Global Strategy

What is Global Strategy?

Global strategy is the type of strategic management that involves doing business in the international domain. In this strategy, a decision is made on how to compete in different global markets-whether through standardizing the product for all global markets or through localizing them to suit the preferences of local consumers. The global strategy focuses on achieving a worldwide presence while managing cultural, legal, and economic disparities across markets.

Distinctive Features:

- Concerned about international expansion and going into foreign markets.

- Tends toward examination and balance between standardization and localization of products.

- Deals with global challenges, such as regulations, competition, and market demand.

Example:

*pioneering Minds

McDonald’s deploys a global strategy by adapting its menus not just to the particular tastes of a country (e.g., McAloo Tikki in India, McSpaghetti in the Philippines) while maintaining the general brand across the globe.

6. Growth Strategy

What is a Growth Strategy?

Growth strategy is the means whereby the expansion of a company is considered concerning revenues, market share, or customer base. This may include any one of the four strategies: market penetration, market development, product development, or diversification.

Distinctive Features:

- Market penetration: Increasing market share in existing markets.

- Market development: Entering new geographic regions or new customer segments.

- Product development: Creating new products for existing markets.

- Diversification: Entering new markets with new products.

Example:

Amazon grew by pursuing a diversification strategy with services from online bookstore to e-commerce giant while also investing in cloud services in the expansion of its business with Amazon Web Services (AWS).

Now we have thoroughly discussed the crucial topic of strategic management, including its definition, significance, and advantages of strategic management, as well as its objectives and goals of strategic management and its various forms.

Where to Study Strategic Management: Best Programs and Institution

Strategic Management is an immensely useful area of study for those professionals wishing to manage organizations in today’s competitive business world. It becomes crucial to choose a reputable institution with a well-rounded curriculum and experienced faculty members if students or working professionals are willing to benefit from a strategic management course. One such institution with a solid reputation and a distinctive programme is CEP, IIT Delhi, which offers an Executive Management Programme in Advanced Strategic Management.

4th Rank in NIRF India Rankings Management – Category (2024)

1st Rank in Asian University Rankings – Southern Asia as per QS World University Rankings 2025 in India

Programme Highlight:

- Certification of completion from CEP, IIT Delhi

- Live interactive sessions by IIT Delhi faculty

- Holistic curriculum covering organisational strategies

- Case-studies driven learning

- Peer-to-peer learning

-

- Graduation (10+2+3) from a recognized university (UGC/AICTE/DEC/AIU/state government/ recognized international universities) in any discipline with a minimum of 4 years of working experience.

-

- Screening and selection will be done by IIT Delhi

-

- Admission will be on the basis of academic background, professional background and performance in the interview process. The programme coordinator will shortlist the candidate profiles.

Your resume will be enhanced by the certificate from CEP, IIT Delhi.

Advantages of Strategic Management

The importance of strategic management aids businesses, whether small or large, in numerous ways. Following are some of the great advantages of strategic management:

1. Clear Direction and Focus

Arguably, the greatest benefit that comes out of the advantages of strategic management is providing clarity of direction for companies. This clarity is derived from formulating a clear mission, vision, and long-term objectives-the business knows precisely where to go and how to get there.

With clarity, employees at all levels will work within the framework of the common goals and objectives. This reduces confusion and greatly aligns efforts. When everyone is on the same page, businesses start to work together more cohesively, with focus and efficiency.

Interactive Question:

Do you think that a clear business strategy increases employee productivity? Why or why not? Please share your thoughts down below!

2. Better Decision-Making

Strategies improve decision-making in an organization by giving a systematic basis for any decision that might be made. With a strategy in place, executives can make good, thoughtful decisions aligning with the organization’s overall direction.

As decision-making in the face of dilemmas or opportunities, a clearer strategy will help those deciding to weigh the risks, costs, and anticipated benefits of each option. In contrast to decisions made on the basis of mere guesswork or short-term expedient behavior, these companies will be able to rely on strategic frameworks to make choices that ensure long-term success.

Example:

In a cost-leadership strategy, the company will make decisions to maintain competitiveness; this might include incurring low operational costs. In contrast, in an innovation strategy, the company will place greater reliance on R&D investments and new product development.

3. Enhanced Organizational Efficiency

The importance of strategic management enables organizations to put their resources to optimal use, thereby improving organizational efficiency. Organizations that align their operations with the strategic objective avoid the wastage of resources and focus on areas that generate maximum value.

For example, by introducing strategies that enhance output while keeping costs to a minimum, a company would seek to streamline its supply chain or improve employee productivity. In short, the advantage of strategic management will ensure that time, money, and human resources are channelled toward activities that require them the most.

Can Strategic Management Boost Organizational Efficiency?

Share your perspective and see how others weigh in!

Strategic management shapes how companies adapt to challenges and opportunities. Whether you’re a leader, employee, or observer, your insights add value to this discussion!

4. Augmented Competitive Advantage

To stay in front of the myriad of people racing to grab an edge in a market with competition as the predominant character, firms must draw some distinct line of departure from each other. Creating a competitive advantage, whether through innovation, customer service, operational excellence, or cost leadership, is one very vital ingredient in the importance of strategic management.

Surveillance of the marketplace and constant readjustments are enough for firms to identify their chances of gaining the upper hand over their competitors. Differentiation through generic means, using state-of-the-art technologies, or developing some sort of consistent customer loyalty can lead to ensuring the organization stays on top of the game in market shares.

Example:

Apple’s competitive advantage results from an emphasis on product innovation and the shaping of a loyal customer base that appreciates sleek designs, high quality, and a seamless user experience.

5. Long-Term Sustainability and Growth

Importance of strategic management, short-term success is only one of the factors competing for the long-term sustainability and growth of the firm. Companies engaged in strategic planning are less likely to be adversely affected by fluctuations in the marketplace, difficult economic times, or changing consumer preferences.

Thus, a holistic strategy will not only take into consideration future pathways for the organization but will also guarantee that the organization can adjust in response to new market conditions. In actual fact, it is those companies that practice the importance of strategic management that have a better chance of moving above and beyond in overcoming the obstacles that the economy throws at them, while also being able to expand.

Interactive Thought:

In your view, which attracts more long-term growth pliable business strategy or one that is steadfast and age-old?

Conclusion: Why Strategic Management is Key to Business Success

Currently, the importance of strategic management is considered to be an organization’s ace for remaining afloat in the competitive and fast-paced business environment. Appropriately formulated and powerfully implemented, strategy is the one thing that stands tall in front of challenges and opportunities being faced by an organisation start-up trying to forge its way into an established giant with possibilities of further growth. Thus, the benefits of strategic management enable the corporation to keep its viewpoint on the long-term objectives, make rational and wise allocation of resources, and be flexible and adaptable to the changing market.

For future professionals and business leaders, Jaro Education offers specialized programs designed by top-ranked institutions that highlight the importance of strategic management. With specialized programs that merge theory into practice, Jaro Education prepares tomorrow’s decision-makers to craft and sustain superior strategies for growth and profits. Jaro Education helps students and working professionals do market assessments with an ROI calculator, identify risks, generate opportunities, and company strategies across various fields.

Thus, giving you a prime partner with the utmost holistic growth and contemporary knowledge on nurturing your objectives and goals of strategic management skills, Jaro Education will help you master these priceless skills to carve out business success.

Some evolution, equally viewed as an ongoing process of adaptation, evolution, and long-lasting success, has really begun. Such Jaro expertise will see your foundation laid for sustainable success in a world packed with denser competition and complications with your business or with your career.

Frequently Asked Questions

Strategic management refers to the process of formulating, implementing, and evaluating strategies to achieve long-term organizational goals. As a candidate, pursuing a career or education in the importance of strategic management will enable you to develop crucial leadership, decision-making, and problem-solving skills. This expertise will allow you to take on roles that involve guiding organizations toward growth, competitive advantage, and long-term success.

To succeed in the importance of strategic management, candidates should focus on developing the following skills:

-

- Analytical skills: Ability to assess market trends, competition, and internal capabilities.

- Leadership: Guiding teams and organizations towards the execution of strategic goals.

- Decision-making: Making well-informed decisions based on data, trends, and business needs.

- Communication: Effectively sharing strategic plans with stakeholders at all levels.

- Adaptability: Being flexible and adjusting strategies as per changing business environments.

- Financial acumen: Understanding the financial aspects of strategy and resource allocation.

To pursue a career with advantage of strategic management, candidates typically require:

-

- Bachelor’s degree: A degree in business administration, management, economics, or related fields.

- Postgraduate degree (optional but beneficial): An MBA or a Master’s in Strategic Management is highly recommended for more advanced roles.

- Certifications: Professional certifications in management or business strategy, such as those offered by institutions like PMI or the Strategic Management Society (SMS), can also enhance your qualifications.

Strategic management provides you with a broad perspective on business operations, helping you make better decisions, manage resources efficiently, and identify opportunities. It also opens doors to senior-level positions such as:

-

- Business strategist

- Chief Executive Officer (CEO)

- Chief Strategy Officer (CSO)

- Consultant for strategy or business development benefits of Strategic management skills are highly valued across industries, enabling you to progress in your career and contribute to a company’s long-term success.