Programme Overview

The Professional Certificate Programme in Investment Banking aims to provide participants with the fundamental theoretical and practical skills employed by investment banks. This programme empowers participants to evaluate critical business functions, comprehend industry trends, and tackle challenges specific to the investment banking field. Conducted through interactive online sessions, this investment banking certification features expert-led lectures, case studies, experiential learning, and practical insights, ensuring a thorough and engaging educational experience.

Gain Executive Alumni Status of IIM Kozhikodes

Certificate of Completion from IIM Kozhikode

Learn from Eminent IIM Faculty and Industry Experts

High Impact Learning: Industry Case Studies, Practical Insights

Assimilate and Apply Learnings via Capstone Project

High-Intensity Classroom: 2-Day In-campus Immersion

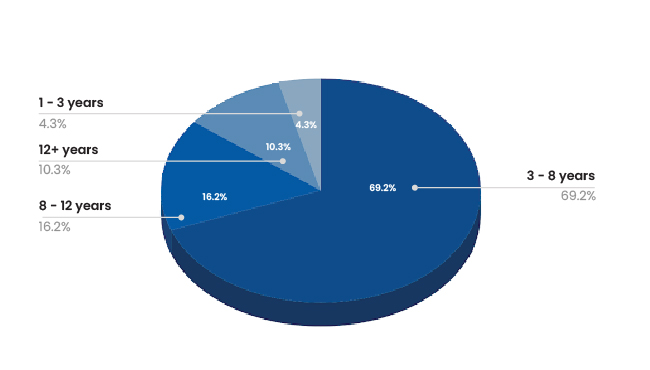

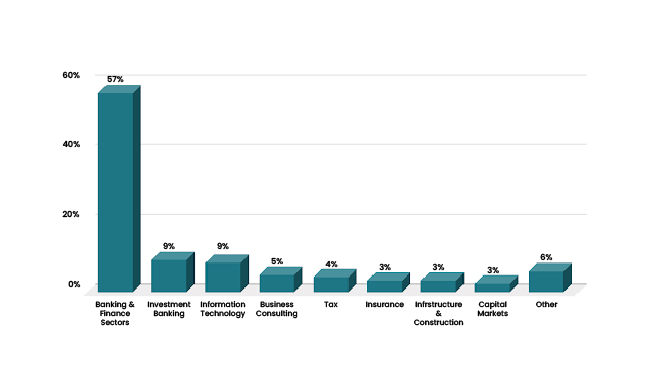

Previous Cohort of Stellar Professionals

Note: All products and company names are trademarks or registered trademarks of their respective holders. Use of them does not imply any affiliation with or endorsement by them.

Programme Content

Module1: Business Communication for Finance Professionals

Module 2: Financial Accounting

Module 3: Fundamentals of Investment Banking& Emerging Trends

Module 4: Corporate Finance

Module 5: Corporate Valuation

Module 6: Mergers, Acquisitions, and Corporate Restructuring (Leveraged Buyouts)

Module 7: Financial Modelling

Module 8: Investment Analysis and Portfolio Management

Module 9: Options, Futures, and Derivatives

Module 10: Supply Chain Finance

Capstone Project

Admission Fee & Financing

Easy EMI Options Available

Pay in easy monthly installments with our EMI options. No more worrying about finances; start your learning journey today!

Complete Payment

Participants can make one-time payment easily using options such as:

Eligibility

- Graduates (10+2+3) or Diploma Holders (only 10+2+3) from a recognized university (UGC/AICTE/DEC/AIU/State Government/recognized international universities) in any discipline.

- By the start of the programme, candidates must hold at least 1+ years of professional work experience (after graduation).

- Junior to Top-Level Executives from BFSI, IB industry.

- Junior to Top-Level Executives from IT companies who have to deal with the aspects of IB.

- Entrepreneurs in the finance space.

- Academicians and Researchers in the area.

- Junior to Top-Level Executives from the PE, VC & Investing Firms

- Post-graduate Students from a Finance background.

- Selections will be based on a detailed Profile in the candidate's own words, elaborating on their Academic record, Profile, Designation, Salary, Roles, Responsibilities, Job Description, and a write-up on “Expectations from the Programme”.

Programme Chair

Certification

- Upon accomplishing the evaluation criteria and satisfying the requisite attendance criteria participants will be awarded by ‘Certificate of Completion’.

- However, if participants are unable to clear the evaluation criteria but have requisite attendance will be awarded a ‘Participation Certificate’.

Professional Certificate Programme in

Investment Banking

- IIM Kozhikode

This investment banking certification programme prepares participants with the latest industry insights and critical skills, ensuring they are ready to excel in the investment banking sector.

Apply Now