- jaro education

- 23, February 2024

- 10:00 am

In today’s dynamic business landscape, proficiency in financial analysis stands as a crucial skill for strategic finance professionals. The capacity to adeptly analyse and interpret financial data is more indispensable than ever before. Mastering financial analysis necessitates not only a profound comprehension of financial statements but also the adeptness to employ various tools and techniques for data analysis, facilitating well-informed decision-making. This blog will help with the indispensable tools and techniques vital for mastering financial analysis, shedding light on their applications in propelling business success.

Understanding Strategic Financial Management

Strategic financial management revolves around achieving profitability and ensuring a satisfactory return on investment (ROI) for the business. This entails the implementation of business financial plans, the establishment of financial controls, and making judicious financial decisions.

To engage in strategic financial management effectively, a company must first articulate its objectives precisely. This involves a meticulous identification and quantification of existing and potential resources. Subsequently, a specific plan is crafted to strategically allocate financial and capital resources toward attaining the defined goals. The scope of strategic financial management extends to a thorough understanding, control, allocation, and acquisition of a company’s assets and liabilities. This encompasses vigilant monitoring of operational financing elements, including expenditures, revenues, accounts receivable and payable, cash flow, and overall profitability.

Table of Contents

Additionally, strategic financial management requires continuous evaluation, planning, and adjustment to keep the company on course toward its long-term objectives. A strategic approach empowers a company to address short-term challenges without deviating from its overarching long-term vision. In short, strategic financial management is a comprehensive and dynamic process guiding a company through both immediate challenges and long-term aspirations.

Financial Analysis Tools

Various tools are accessible for analyzing financial data, each equipped with distinct features and capabilities.

Excel

Renowned for its versatility, Excel is adept at handling a broad spectrum of financial data analysis tasks. It offers an array of built-in functions for data manipulation, visualization, and statistical analysis.

Python

Python, a widely used programming language, is a favorite for data analysis. Its extensive community support and numerous libraries like Pandas and NumPy make it an ideal choice for financial data analysis.

R

Specifically designed for statistical computing and data analysis, R is a programming language with an environment that boasts a rich selection of packages and tools. Examples include the Tidyverse and Shiny, which are valuable for financial data analysis.

These are just a few instances of the myriad tools available. Opting for the right tool enhances the efficiency of finance professionals, enabling streamlined workflows and increased data value.

Data Mining in Finance

Data mining, extracting valuable insights from large datasets, is pivotal in finance. It employs algorithms and statistical techniques to unveil patterns and trends, aiding in tasks like predicting stock prices, detecting fraudulent activity, and identifying market trends.

Common techniques in data mining for finance include:

Clustering

This method involves grouping data points into clusters based on their similarities. For instance, a financial analyst may employ clustering to categorize stocks based on performance or risk profiles.

Classification

This technique utilizes labeled data to train a model for predicting the class or category of an unseen data point. For example, predicting whether a customer is likely to default on a loan based on credit history falls under classification. It extends to predicting outcomes such as stock price movements or detecting fraudulent activities.

Regression

Involving the examination of relationships between two or more variables, regression is useful for financial analysts to explore connections such as between a company’s stock price and its earnings per share (EPS).

Association Rule Mining

This method focuses on identifying patterns of co-occurrence in datasets. For finance professionals, association rule mining could uncover which financial products are frequently purchased together by customers.

Financial Modelling

Financial modeling involves creating mathematical representations of financial situations or systems. This process aids in forecasting future financial performance, evaluating scenarios, and assessing business plan feasibility.

There exist various types of financial models, including:

Discounted Cash Flow (DCF) Models

These models predict a company’s future cash flows and discount them back to the present to ascertain their current value. DCF models are frequently employed to estimate the intrinsic value of a stock.

Monte Carlo Simulations

These models utilize random sampling to generate a spectrum of potential outcomes for a financial scenario. They are commonly utilized to evaluate the risk and uncertainty associated with financial decisions.

Decision Tree Models

These models adopt a tree-like structure to depict the potential outcomes of a series of decisions. They are often used to assess the potential returns and risks associated with various investments.

Financial modeling equips finance professionals with the tools to comprehend the impacts of various scenarios on a company’s financials, facilitating more informed decision-making.

Financial Data Visualisation

Numerous tools are at one’s disposal for visualizing financial data, including:

Tableau

Recognised as a potent data visualization tool, Tableau enables users to craft interactive charts, maps, and dashboards. It proves especially beneficial for delving into and analyzing extensive datasets.

Power BI

Positioned as a cloud-based data visualization and business intelligence platform, Power BI empowers users to develop interactive dashboards and reports. It encompasses features for data modeling and analysis, enhancing its utility.

Excel

With an array of inherent features for data visualization such as charts, graphs, and pivot tables, Excel stands out as a versatile tool capable of creating a diverse range of visualizations.

Through the utilization of these and additional tools for financial data visualization, finance professionals can convey their discoveries and insights more effectively, facilitating more discerning decision-making.

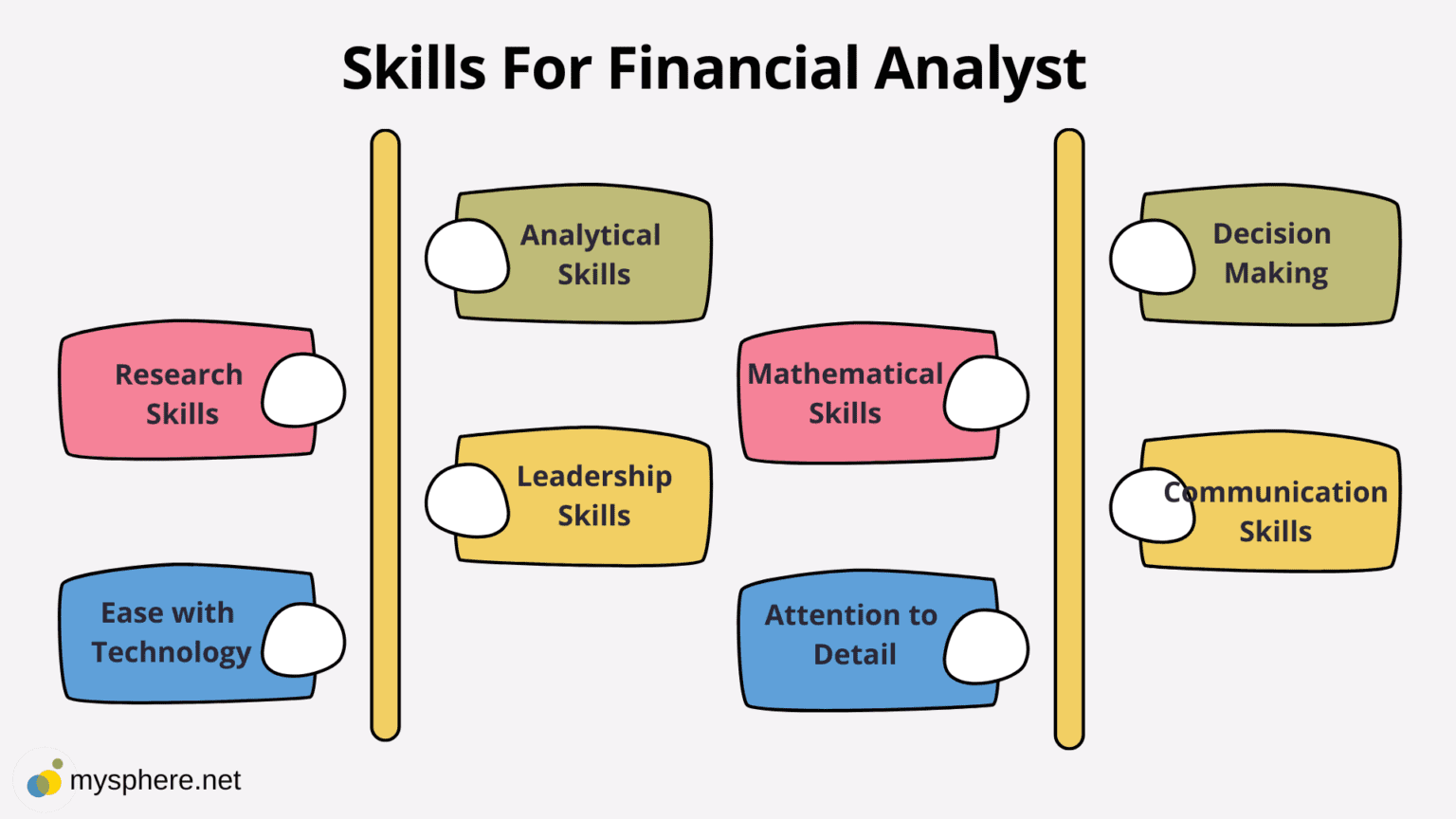

Skill Sets for a Financial Analyst

Financial analysts require a diverse skill set encompassing both hard and soft skills. Employers seeking to hire financial analysts often look for the following skill sets:

Accounting Skills

Financial analysts need a strong foundation in accounting, including knowledge of principles, standards, and techniques. This includes expertise in budget calculation, cost analysis, cash flow management, general ledger maintenance, bank statement reconciliation, and proficiency in accounting software and mathematical formulas.

Interpersonal Skills

Possessing strong interpersonal skills is crucial for effective collaboration with colleagues and investors. Financial analysts should be adept at interpreting nonverbal communication cues, presenting projects, and working seamlessly within a team.

Communication Skills

Effective communication is vital for financial analysts, influencing both interpersonal relationships and professional interactions. This includes clear and direct communication in emails, phone messages, and discussions with investors, as well as the ability to convey financial information professionally.

Problem-Solving Skills

Financial analysts are problem-solvers, whether resolving financial equations or finding innovative solutions to complex financial issues a company may face. Creative problem-solving is particularly valuable in critical situations.

Technical Skills

Proficiency in using advanced accounting and bookkeeping software, such as Hyperion, SAP, SQL, and QuickBooks, is often required. Additionally, financial analysts should demonstrate the ability to quickly learn and adapt to new software applications.

Leadership and Management Skills

As financial analysts may lead finance departments or teams, strong leadership skills are essential. This includes effective team communication, professional mentoring, and the ability to direct collaborative efforts.

Financial Literacy Skills

Financial analysts must possess financial literacy and an understanding of current investment markets, lender interest rates, and other financial events. This knowledge is crucial for making informed decisions and recommendations.

Critical-Thinking Skills

Critical thinking skills are essential for evaluating complex financial situations, making decisions about investments, and strategically planning for the future. Financial analysts must be able to think critically before making significant financial decisions.

Organisational Skills

Given the need to manage financial records and processes, organizational skills are vital for financial analysts. This includes the ability to organize and maintain accurate financial data for the organization.

Analytical Skills

The ability to analyze, forecast, plan, prioritize, and solve financial problems is a key quality of effective financial analysts. These skills involve strategic planning and analysis of financial resources, markets, and products to support sound decision-making within the organization.

*mysphere.net

How do You Improve as a Financial Analyst?

To elevate your proficiency as a financial analyst and advance in your career, consider the following detailed steps:

Thoroughly Identify Areas for Improvement

Conduct a comprehensive assessment to pinpoint specific aspects of your financial analyst skills that require enhancement. Whether it’s refining communication with supervisors, mastering the intricacies of new accounting technologies, or honing analytical capabilities, a detailed identification lays the groundwork for focused development.

Precisely Define Improvement Goals

Once areas for improvement are identified, articulate clear and achievable goals. For example, establish a timeline for becoming proficient in the use of the company’s latest accounting software. Setting specific targets provides a roadmap for measurable progress and success.

Leverage a Variety of Tools and Resources

Explore a diverse range of tools and resources to aid in achieving your skill development goals. For those tackling a new accounting program, delve into comprehensive user guides, and engage with knowledgeable colleagues who can guide you through the intricacies of the software. Utilize online tutorials and attend workshops to access a wealth of learning resources.

Engage in Professional Training

Commit to continuous professional development by actively participating in training sessions, specialized courses, and industry-relevant workshops. If you foresee a leadership role in an upcoming team project, enroll in leadership training programs to acquire the necessary skills for effective team management and project leadership.

Strategically Implement Technological Resources

Embrace technology as a strategic ally in your skill development journey. Utilize how-to guides, instructional videos, and online platforms to navigate and master the components of new accounting software. Integrating technological resources into your learning approach can enhance efficiency and comprehension.

By meticulously following these steps, you can methodically enhance your capabilities as a financial analyst, contributing to your professional growth and staying attuned to the evolving landscape of the financial industry.

Final Thoughts

Mastering financial analysis is essential for those looking for guidance in the complexity of strategic finance. The acquisition of tools and techniques in this domain lets individuals and organizations make informed decisions, reduce risks, and take advantage of opportunities. By developing one’s financial analysis skills, one not only gains a better understanding of a company’s financial health but also develops the ability to create solid strategies that contribute to long-term success.

So, by now you know that staying ahead requires a firm grasp of contemporary financial concepts, analytics, and strategic acumen. Recognizing this imperative, IIM Mumbai has intricately crafted an Executive Certificate Program in Corporate & Strategic Finance for both experienced finance professionals and budding financial leaders. This strategic finance course is geared towards equipping participants with an in-depth understanding of crucial financial concepts, strategic approaches, essential financial statements, and the latest fintech innovations. Emphasizing experiential learning through case studies, interactive sessions, etc., the course is designed to align with the theme of mastering financial analysis, providing participants with the tools and techniques essential for strategic financial proficiency. Enroll now to elevate your career and navigate toward growth with confidence.